Inflation and interest rate rises were the dominant drag on equity returns in 2022 as they caused the market multiple to fall. The lagged effect of a rapid increase in interest rates will now cause the global economy to slow, unemployment to rise and wage inflation to fall, just as the Fed intended.

Weaker company profits will be in the spotlight in 2023, leading to another year of soft equity markets. A capitulation in private markets could be the sting in the tail.

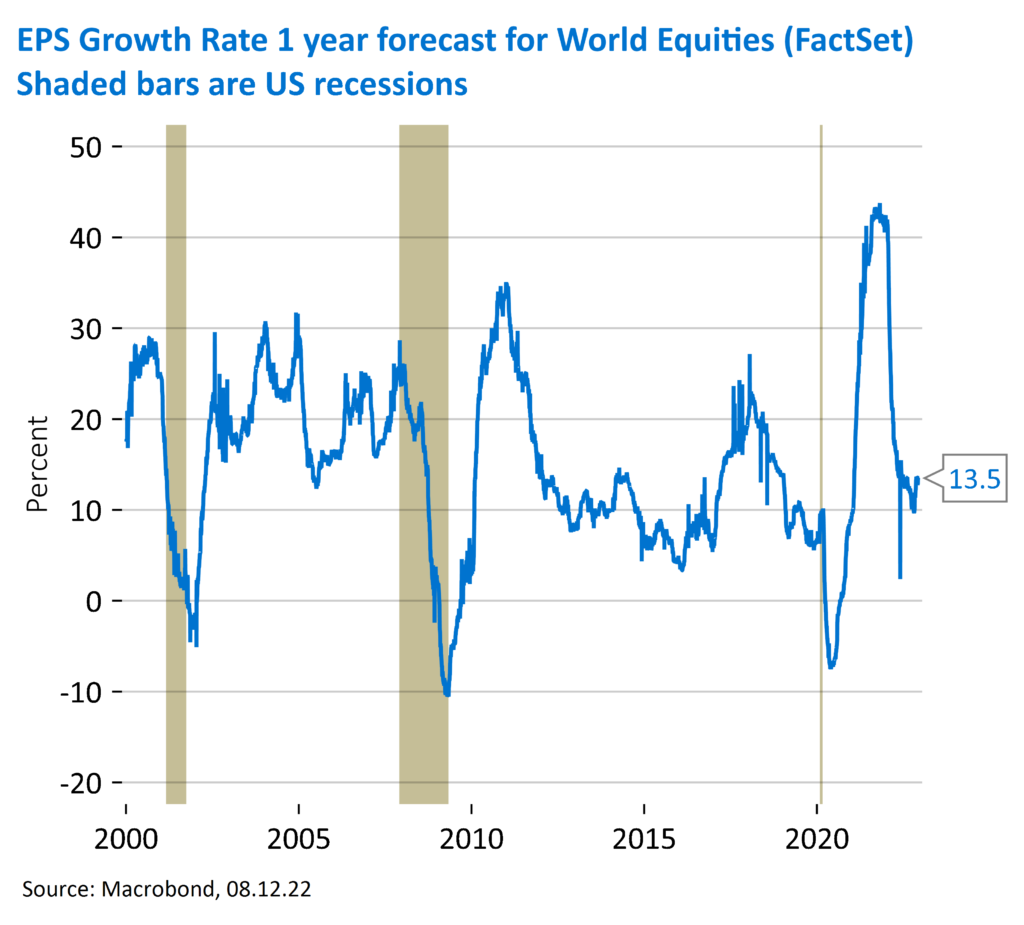

Equity markets in 2022 were dominated by inflation and interest rates, but the outlook for company earnings has taken a back seat. This is likely to change, because defeating inflation with interest rates requires a reduction in demand that is near impossible to achieve without reducing corporate profits. We could therefore see earnings expectations become the dominant narrative of 2023, but attempting to time markets will be folly. Some market participants expect earnings downgrades to trigger a swift sell-off early next year followed by a recovery; the reality may be a gradual fade in earnings expectations over many months.

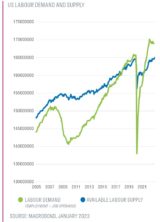

To prevent inflation becoming entrenched, the Fed must reduce wage inflation, but this can only be achieved by constraining demand for labour. Monetary policy is a blunt tool that acts with a lag, but when tightened sufficiently it will slow economic growth and labour demand. The extent to which rates need to be raised to slow growth is difficult to gauge, but the resilience of the US economy in the face of the most aggressive monetary tightening since the early 1980s suggests that US interest rates may need to rise to the 5-6% range, above core inflation, and stay there until wage inflation moderates. Fed Chair Jerome Powell has made it clear that he does not intend to repeat past mistakes by easing policy too soon, so expectations that US interest rates will fall and support a higher equity market multiple may be misplaced.

Developed market equities are not yet priced for a recession

While higher interest rates raise the probability of economic contraction and weaker profits, we have not yet seen a significant decline in earnings expectations. Instead, the bulk of 2022s 26% decline in the MSCI ACWI ($) to its intra-year low on 12 October was been driven by higher interest rates and bond yields, which reduce the amount that investors are willing to pay for future profits. It is notable that US 10-year government bond yields, which started the year at 1.5%, peaked at 4.2% in October, dovetailing neatly with the equity market’s October low.

What could we expect to see in terms of lower earnings expectations, and what impact could this have on equity markets? In recessions since 1960, corporate profits have fallen on average by 30% from peak to trough, yet consensus expectations for 2023 earnings are still optimistic, despite a high and rising probability of recession. With the US equity market trading on a multiple of 18x current forecast earnings, many investors clearly expect an economic soft landing followed by a swift return to growth, but expectations for 2023 profits have started to slip and downgrades are evident in sectors such as e-commerce and online advertising, where there was unsustainable profitability during the pandemic.

As interest rates continue to rise, economies slow and the outlook for the jobs market sours, the demand for services will also contract. The consequence is likely to be a slow grind lower for profit expectations throughout 2023, potentially into the -10% to -15% range. This will undermine equity market valuations and investor confidence.

We believe that developed market equities are not yet priced for a recession, suggesting further downside for equities. For example, at 18x 12m forward earnings and a Shiller PE of 29x, the US equity market is not priced for a double-digit decline in profits in 2023. The US earnings yield on this basis would be below 5%, an insufficient equity risk premium versus a 3.6% yield on a 10-year government bond. Assuming a 15x PE multiple on US$200 of S&P 500 earnings – which is quite likely in a modest recession – this implies as much as 25% downside at the index level.

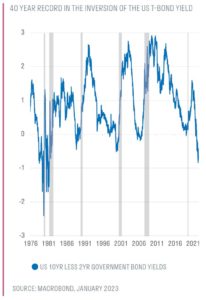

US yield curve is as inverted as it has been for 40 years

All current indications point to an impending recession. The US yield curve (3-month rates less 10-year rates) is as inverted as it has been in 40 years, implying weakening nominal growth in the quarters ahead, and the US monetary supply has declined by 4% annualised in the three months to October – the biggest decline since the data began in 1959, according to Jefferies. Meanwhile, economic indicators such as the Chicago PMI suggest a high probability of recession and leading indicators of industrial company profits, such as the ISM Manufacturing index, suggest a slowdown is imminent.

Industrial cyclical companies are now likely to see order growth decline, but given the scarcity of labour management may choose to retain skilled staff and invest in supply chain resilience. This will squeeze margins in the short term, but may pay off when economic recovery finally comes.

So far, the service economy has been supported by accumulated savings, wage inflation and index-linked benefit payments, but savings have declined (in the US from 9.5% of disposable income in August 2021 to 2.3% in October 2022) and consumer use of credit is rising. Housing markets are softening, credit and lending standards tightening, whilst consumer confidence remains depressed amidst the growing cost of living crisis.

We must be mindful of hidden risks in the shadow financial system

While private equity may enjoy the luxury of not reporting quarterly earnings, it is no more immune to recessions and lower asset valuations than public markets. Private markets are also considerably larger than the past, due to increased investor allocations and abundant cheap capital. This raises systemic risk, as we have already witnessed in crypto currencies, liability-driven pension funds, property funds and some emerging markets.

Venture capital funds will eventually have to reprice their assets to reflect the challenging environment, but will also need to raise follow-on capital from investors to support the cash burn of early-stage companies. The high allocations to private markets held by long-standing investors, and the presence of newer and more aggressive investors in the industry, could force sales of more liquid, publicly-quoted assets to fund cash call obligations.

Until inflation comes back towards central bank targets, interest rates fall and economic growth recovers, we must be mindful of hidden risks in the less-liquid (and lightly regulated) shadow financial system. That said, any upset in private equity will also present choice buying opportunities in the secondary market for investors such as Sarasin’s Bread Street private equity arm.

Market leadership tends to change in the aftermath of a bear market

Attempting to time markets can be extremely counterproductive, but we can reflect the risks we see ahead in our portfolio construction. During the most recent bear market rally, in which cyclicals outperformed we took the opportunity to reduce our positions in cyclical stocks in favour of more defensive companies and a higher cash weighting in anticipation of a weak reporting season and cautious management guidance.

Cyclicality is by no means the preserve of commodity and ‘old economy’ companies. In past cycles, technology earnings have been almost as cyclical as industrial companies, so caution is warranted despite tech’s recent fall to earth. Furthermore, market leadership tends to change in the aftermath of a bear market, so we must consider whether large tech stocks will drive the eventual market recovery. For these reasons we prefer to adopt a selective approach that emphasises reasonably valued companies that can optimise margins by shedding unprofitable activities.

Stock market leadership in the recession phase will favour higher quality companies with strong balance sheets. The stock prices of these companies were less defensive in the first phase of the bear market as their valuations adjusted to higher interest rates. However, in past periods of high but falling inflation, high-quality companies in sectors such as medical equipment, semiconductors, software, and staples have tended to provide the best opportunities.

The coming year should see a focus on company fundamentals rather than macroeconomic variables and geopolitical events, that should produce greater stock dispersion and higher rewards for well-researched stock picking. Even though asset prices have corrected from their 2021 highs, future investment returns could be modest compared to those enjoyed since the 1980s. This will make equities an even more crucial element in return-maximising portfolios as benchmark outperformance, or ‘alpha’, becomes extremely valuable and the new, broader market leadership will benefit active investors. The recession phase of this bear market will create stock picking opportunities within all of our themes as short-term disappointment causes the market to temporarily lose sight of the long-term upside.

Important information

If you are a private investor, you should not act or rely on this document but should contact your professional adviser. This communication is sent on a confidential basis, and you are welcome to discuss the materials with our staff. This information may not be circulated to others without our permission.

The information on which the document is based has been obtained from sources that we believe to be reliable, and in good faith, but we have not independently verified such information and no representation or warranty, express or implied, is made as to their accuracy. All expressions of opinion are subject to change without notice.

US Persons are able to invest in units or shares of Sarasin & Partners LLP funds if they hold qualified investor status and enter into a fully discretionary investment management agreement with Sarasin Asset Management Limited. US persons are U.S. taxpayers, nationals, citizens or persons resident in the US or partnerships or corporations organized under the laws of the US or any state, territory or possession thereof.

This document has been prepared by Sarasin & Partners LLP (“S&P”), a limited liability partnership registered in England and Wales with registered number OC329859, authorised and regulated by the UK Financial Conduct Authority and approved by Sarasin Asset Management Limited (“SAM”), a limited liability company registered in England and Wales with company registration number 01497670, which is authorised and regulated by the UK Financial Conduct Authority and registered as an investment adviser with the US. The information in this document has not been approved or verified by the United States Securities and Exchange Commission (SEC) or by any state securities authority. Registration with the SEC does not imply a certain level of skill or training.

Please note that the prices of shares and the income from them can fall as well as rise and you may not get back the amount originally invested. This can be as a result of market movements and also of variations in the exchange rates between currencies. Past performance is not a guide to future returns and may not be repeated. Management fees and expenses are described in SAM’s Form ADV, which is available upon request or at the SEC’s public disclosure website, https://www.adviserinfo.sec.gov/Firm/115788.

For your protection, telephone calls may be recorded. SAM and/or any other member of Bank J. Safra Sarasin Ltd. accepts no liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of his or her own judgment. SAM and/or any person connected to it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document.

© 2023 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP.