The world’s supply of fresh water is finite, but demand is rising. Pollution and climate change will only make this worse. Private companies and investors can play a vital role in addressing the world’s need for sustainable fresh water.

Water, water everywhere

About 71% of the earth's surface is covered in water, but only 3% of the world’s water is fresh. Of this 3%, a mere 0.5% is available for us to use. This is because most of the earth’s fresh water is locked up in glaciers, polar ice caps and the atmosphere or lies deep underground. Furthermore, a growing proportion of the ‘fresh’ water available to us is polluted and unfit for domestic, industrial and agricultural use.

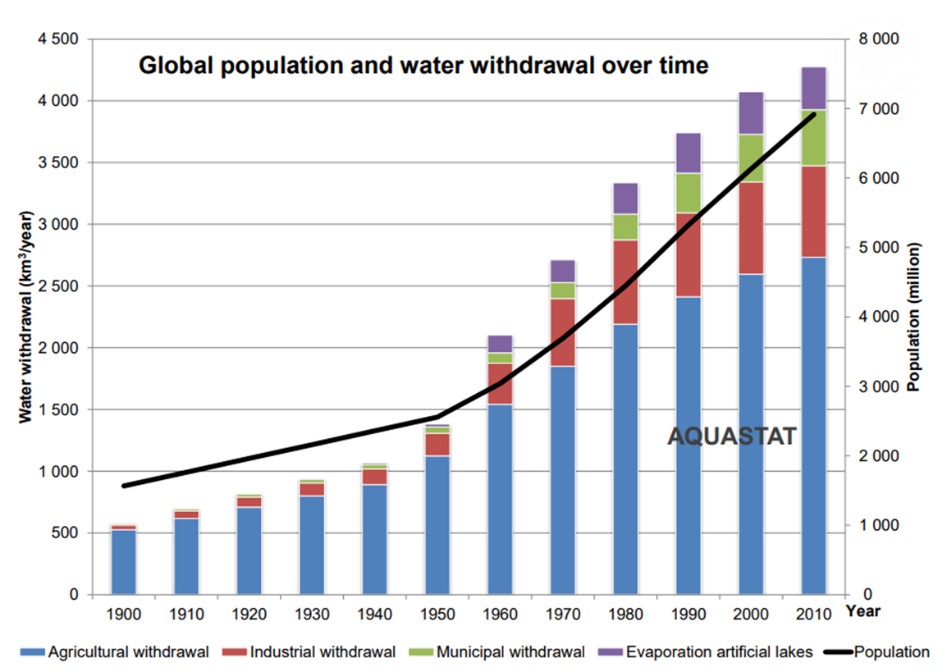

While the earth’s population has grown rapidly, the amount of water available remains broadly the same.

Clean water is a basic need

Clean water is essential to us all: to ensure that basic social needs are met and a nation’s economic development is secured, water availability must be sustainable. The current high use of water is largely unsustainable and the price paid for it is too low to accurately reflect its true value.

Current water use is also a cause of inequality, with overconsumption in some areas while other regions suffer stress and scarcity. Residents of poor countries are four times less likely to move to escape issues such as water scarcity or pollution and seek better living and working conditions.

To focus efforts on addressing these issues, the UN has singled out the availability and sustainable management of water and sanitation for all by 2030 as one of its 17 Sustainable Development Goals.

Demand is rising

Demand for water is rising, primarily due to population growth and associated agricultural and industrial use. Between 2012 and 2050, water demands are expected to increase by 400% from manufacturing, and by 130% from household use.1 However, the largest source of increasing demand for fresh water is agriculture, especially in Asia.

By 2030, billions of people around the world will be unable to access safely managed household drinking water, sanitation and hygiene services unless the rate of progress in providing sustainable water and sanitation quadruples.2

The cost to business

The potential costs of water-related risks to business is estimated by CPD to be $301bn, five times higher than the cost of taking action to improve corporate water use. This makes water scarcity the biggest climate-related threat to corporate assets within the next few decades. Most at risk are physical assets with fixed locations owned by companies in the utilities, materials, energy and consumer staples sector.

Companies themselves are increasingly aware of what could be at stake. It is heartening to see a 20% surge in companies disclosing water data in 2020, but action has been mixed. Almost two-thirds of companies are reducing or maintaining their water withdrawals, but progress remains stagnant on pollution, with just 4.4% of companies making progress against pollution reduction targets.3

Source: FAO, Aquastat. Total freshwater use has increased by a factor of six over the past 100 years and continues to rise by 1-2% annually. Agriculture is the largest source of new demand, followed by industry.

Water pollution: squandering one of our most precious resources

Globally, water quality is deteriorating, the main culprits being industrial and municipal waste, agricultural fertiliser run-off, climate change and poor or ageing infrastructure that cannot keep pace with rising populations.

Nearly all major rivers in Africa, Asia and South America have experienced a marked decline in water quality since the 1990s. Developed areas of the world also face pollution issues. In the UK, recent improvements in water testing have revealed that most of the UK’s waterways and rivers contain previously unidentified pollution.

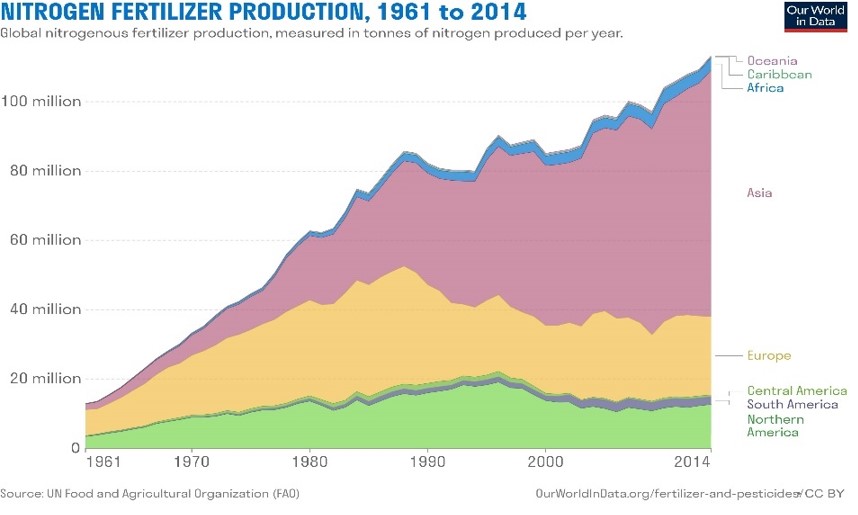

Agricultural practices, particularly the widespread use of nitrogen-based fertilisers, have become a major source of water pollution over the past 60 years, with nitrogen run-off causing aquatic life to decline.

Source: Food and Agricultural Organization of the United Nations FAOSTAT database: https://www.fao.org/faostat/en/#data/RA; Roser and Ritchie 2019.

The increasing use of nitrogen fertiliser is a major contributor to poor water quality and degradation of the natural environment

Climate change will intensify water scarcity

Overall, our planet has plenty of rain, but not necessarily where we need it most. Climate change will only exacerbate current problems associated with weather patterns and water scarcity. Wet areas of the world will get wetter, while dry areas of the world will become a lot drier.

Changing weather patterns are already having a significant impact on poorer areas of the world, and are also beginning to affect everyday life in developed areas. A recent eye-opening example of this is the ongoing worldwide shortage of semiconductors. Taiwan-based TSMC, one of the world’s largest manufacturers of the semiconductors, uses 150,000 tonnes of purified water per day. A contributing factor to the shortage was a drought in Taiwan that forced TSMC to reduce production in order to preserve water for domestic and agricultural use.

More than 85% of people affected by rainfall variability live in low- or middle-income countries, so these changes will create further inequality between rich and poor.

‘Most drinking water to this day is treated using World War I-era technology.’

Erik Olson, Natural Resources Defence Council

Our water infrastructure is not up to the task

While the issue in developing areas is often a lack of infrastructure and water treatment, more developed areas face the problem of obsolete legacy infrastructure. In the US, approximately 30% of the infrastructure used to collect, treat and transport water is over 50 years old and long overdue for replacement.

Corroded pipes are a significant health and environmental risk that can result in contamination of drinking water. The unfortunate poster child for the US’s failing water infrastructure is Flint, Michigan, where acidic corrosion of lead pipes exposed Flint residents to heavy metals poisoning.

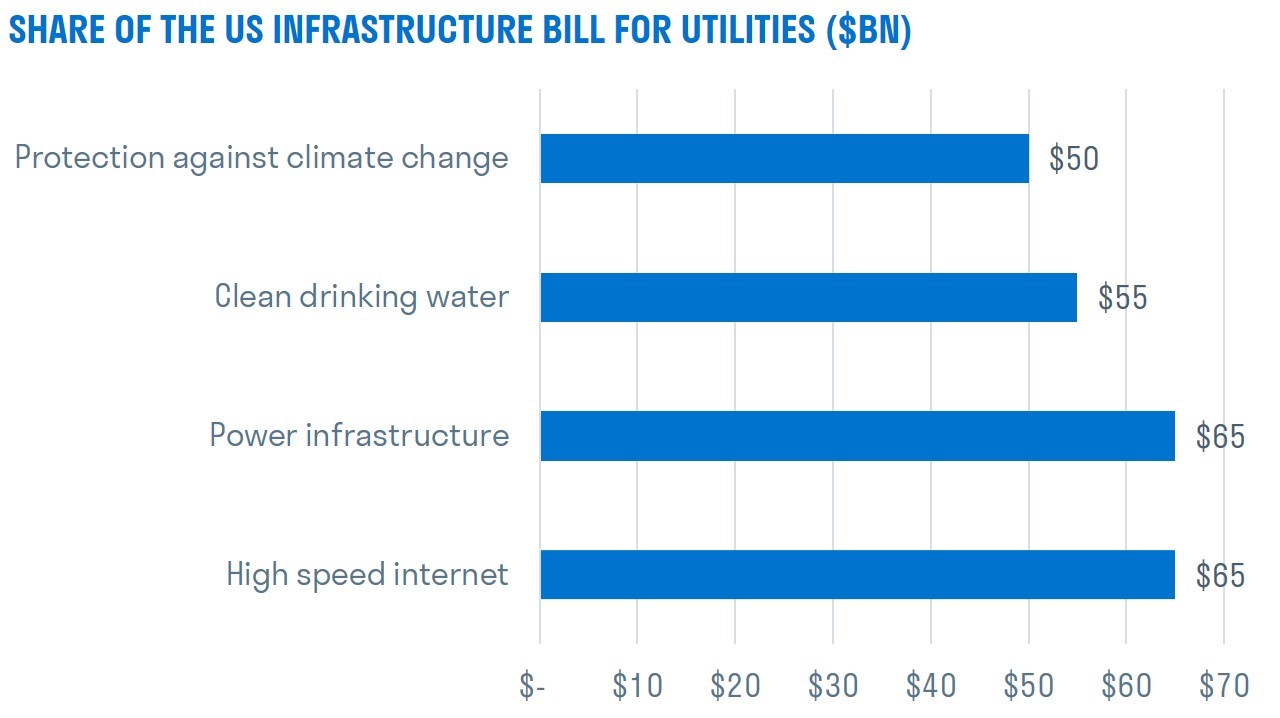

Replacing water infrastructure on a large scale is a long-term project with high costs. An eyewatering $55bn of President Biden’s $235bn infrastructure spending package has been earmarked for water infrastructure. Meeting the UN’s global sustainability goals for water and sanitation will require trillions, not billions of dollars.

Source: White House Briefing Room fact sheet, The Bipartisan Infrastructure Deal, 06/11/2021

Water as an investment theme

Private companies and investors have a key role to play in implementing change to protect water sources, upgrade water and waste management and meet sustainable development goals. Naturally, the potential investment opportunities are wide and diverse because water is a resource that permeates everything we do – from making tea to making semiconductors.

Within our thematic investment process, we consider water-related investment opportunities as part of our Climate Change theme, under our environmental resources subtheme. Our research into water-related investments has, to date, resulted in us forgoing some initially promising ideas, but has also led us to a number of attractive and impactful investment opportunities in following areas:

- Water usage management

- Improving water quality and controlling pollution

- Water infrastructure

- Technology

As ever, it is imperative to ensure that the companies in which we invest offer good long-term thematic growth prospects and good (or improvable) ESG credentials, together with the appropriate size and liquidity for our investors’ needs.

Investment in water utilities, although it appears to be a natural entry point into water-related investment, carries substantial regulatory risk that could impact profitability. Furthermore, some apparent solutions to water scarcity cause environmental harm, such as desalination. In addition, many water-related companies are simply too small, lack market share or specialise in unestablished technologies. Other companies may be well-established but face significant risks to their profitability. For these reasons, we have been highly selective in creating a short-list of stocks that we will consider for inclusion in our clients’ portfolios.

Who will buy?

A key distinction that investors in water-related companies must make is between need and demand. In other words, who will pay for the services of water consultancy and technology companies? For example, Xylem, a global leader in pumps, water technology and water management, played an instrumental role in helping Singapore to radically improve its water and waste management systems. However, Singapore is unusual in being able to fund a major upgrade to its water systems.

We are likely to see the strongest demand for companies providing water-related solutions in developed areas of the world, where infrastructure funding is more likely to be available. These include the services and products provided by companies such as Ecolab (a Sarasin portfolio holding; water management, hygiene and infection prevention), Tetra Tech (a Sarasin portfolio holding; water management consultancy) and ThermoFisher (water quality analysis).

However, opportunities do exist elsewhere. Xylem, for example, operates in 150 countries. While most nations will not be able to afford high levels of funding for water infrastructure, there are widely distributed opportunities in the private sector, such as companies that require dependable sources of pure water for their manufacturing or agricultural processes.

Meanwhile, Deere is a global leader in agricultural machinery that enjoys strong growth prospects as a result of automation in agriculture. In the process, Deere will have increasing opportunities to distribute its irrigation products and services.

Xylem – A global leader in water technology

Xylem is a market-leading, US-listed water technology business with annual revenues of over $5bn that operates in 150 countries. Its products are used by public utilities, companies and individuals to transport, test, treat and use water. They include leak detection technology, smart meters, data analytics and predictive maintenance.

We believe that Xylem can look forward to strong structural growth due to the widespread need to replace water management assets and improve efficiency in the supply and treatment of fresh and waste water.

Xylem aims to cut its own water usage by 25% and waste to landfill by 20% by 2019 (from 2014). The company also has a goal to help its customers save 16.5 billion cubic meters of water through use of advanced technology by 2025 and prevent over 7bn cubic meters of polluted water entering waterways.

Tetra Tech – Water management consultancy

Tetra Tech provides advice, planning, and implementation work in areas such as watershed management, wastewater and stormwater treatment, and flood control.

In the medium term, Tetra Tech’s expertise is likely to be in demand in the US in the wake of President Biden’s infrastructure stimulus package, which has earmarked $55bn for improving water infrastructure.

Longer term, we can expect Tetra Tech’s consultancy expertise to be in increasing demand as a result of climate induced changes in water stress patterns, extreme weather events, sea-level rises and growing evidence of an impending water crisis across major swathes of the US.

1OECD, 2012. Environmental Outlook to 2050: the consequences of inaction

2World Health Organization (WHO) and the United Nations Children’s Fund (UNICEF)

3Source: CPD, 19/03/2021, https://www.cdp.net/en/articles/media/cost-of-water-risks-to-business-five-times-higher-than-cost-of-taking-action