One lasting impact of COVID-19 has been the exacerbation of existing societal inequalities.

Women have been particularly affected by the pandemic for a number of reasons, including the fact that they make up the majority of the service industry, and that the burden of childcare tends to fall to women.

The anniversary of the declaration of the pandemic is a good time to assess where we are with respect to addressing gender inequalities.

Pressing for increased female representation at the Board level is not just the right thing to do, but makes financial sense. Greater board diversity has been shown to enhance shareholder returns through better decision-making. This is particularly important in building business resilience; a diverse board is more likely to have considered potential challenges from a range of perspectives, and avoid herd-like thinking.

Diversity and inclusion within the workforce is also a key priority for us, particularly the advancement of women and minorities into senior leadership roles. Research from McKinsey in 20191 indicates that companies with the most gender diverse executive teams are 25% more likely to have above average profitability than the companies with the least gender diverse executive teams, up from 21% in 2017 and 16% in 2014.

Companies with the most gender diverse executive teams are 25% more likely to have above average profitability

A similar picture emerges when it comes to ethnic and cultural diversity, with the most ethnically diverse companies even more likely to have above average profitability than the least ethnically diverse companies. Furthermore, the gap between these diversity winners and laggards is widening.

How do we assess progress?

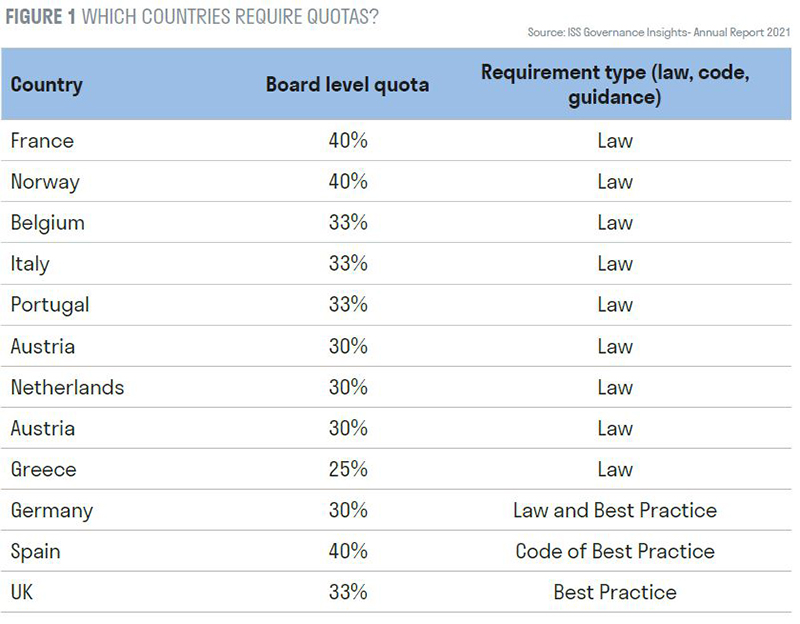

As global investors, we assess progress beyond the UK and note that the areas of fastest improvement at the board level tend to be in regions with laws and quotas. As seen from the table below, it is mainly western European countries that currently have mandatory quotas in place. These quotas are typically set at or above the 30% level, which is the threshold that research2 suggests is the minimum for minority groups to impact boardroom dynamics.

As a result, we see regional disparity in our investee companies. It is no surprise that the companies in our portfolios with the highest female representation come from the regions with quotas noted above. In regions without mandatory quotas, the progress is more mixed and, in these regions, investor scrutiny is most needed.

In the UK, progress over the past five years has been encouraging. The number of female directors at FTSE 100 firms has increased by almost 50% in the last five years3, and women now comprise more than a third of the directors of FTSE 350 companies. This pace of change has been largely due to the introduction of targets via the Hampton-Alexander review launched in 2015, and the efforts of investors and civil society organisations such as the 30% Club.

Women now comprise more than a third of the directors of FTSE 350 companies

If we look at our UK portfolios, it is encouraging to see that approximately 70% of our UK investee companies have crossed the 33% board diversity threshold, but clearly there is still a way to go to achieve 100%. Additionally, while a handful of UK boards have achieved gender parity (and in the case of Diageo exceeded it with 60% female representation), this is not yet the norm and we are also still seeing a handful of companies on our buylist that have only one female director on the board.

In the US, progress is being made, albeit at a slightly slower speed. We see good examples of board diversity in large companies such as Facebook, Merck, Microsoft and Estee Lauder who are all above 40% female representation4. But if we apply a 30% board diversity threshold to our US holdings, we see approximately 62% meet this minimum. If we increase the threshold to the same as the UK, a 33% minimum, the companies meeting this guideline drops to 44%. Clearly there is still much to be done.

Going even further afield, we see the least improvement in companies based in Asia, predominantly China, Japan and Korea. In these regions, it is unfortunately still common to see all male boards, or boards with a single female director.

So what are we at Sarasin doing about it?

How do we press for change as investors?

To increase diversity in our investee companies, we engage directly on the issue, we support shareholder resolutions, we collaborate with other like-minded investors and we hold individual directors accountable. We touch on some of our actions in 2020 below.

How we vote for gender diversity

We vote against boards with no female representation globally. In 2020, our minimum expectation for companies in the UK, US and western Europe was 25% female representation. We vote against the Chair of the Nomination Committee, and potentially other directors, if this expectation is not met. Looking ahead to the 2021 AGM season, we have toughened our stance and now press for a minimum of 30% female representation in the US, Canada, Australia and Western Europe (33% in the UK).

In 2020, we voted against the election of 54 directors based on insufficient female representation at the board level. In 2019, we did not support the election of 124 directors for similar reasons. The reduction in the number of ‘against’ votes reflects the clear progress some companies have made in the past year, but the overall pace of change has been too slow. With our tougher expectations for 2021 we anticipate that there will be a substantial increase in votes against.

Supporting shareholder resolutions

In the US and Canada, it is more common for shareholder resolutions to be raised on ESG issues. In 2020, we noticed an increase in shareholder resolutions explicitly calling for gender and racial pay gap disclosures, as well as for employment diversity reports. We are supportive of this trend and expect it to continue.

In 2020, we supported diversity related shareholder resolutions filed at Pfizer, Bank of Nova Scotia, Marriott, Amazon, Alphabet and Home Depot.

The workforce diversity resolutions at Marriott and Home Depot received approximately 35% votes in favour. This is significant as it serves to highlight investor expectations for greater transparency, allowing scrutiny of companies’ diversity programmes and initiatives.

Engaging for change

From 2020, we have initiated a post-proxy communication effort with our clients’ companies, as we tie our voting to our engagement. Where we have voted against company resolutions, we are writing to the Chair to set out why. In this initial year, we wrote to 42 companies which were selected based on the significance of the voting issues identified and the materiality of our holdings.

We have notified these companies that for the 2021 AGM season we are specifically assessing whether a company has taken meaningful steps to improve diversity within the Board and amongst senior executives. We will also be conducting targeted outreach to companies where we see the least progress being made.

We are also paying particular attention to the quality of roles assigned to female directors. In the longer term we will consider the appropriate way to assess diversity in a broader sense such as consideration of ethnicity and beyond. We continue to collaborate with other investors to press for change predominantly via our membership of the 30% Club UK investor group.

What’s different this year as a firm?

And last but not least what are we doing within our own firm in this area? Diversity and inclusion is a key focus for Sarasin & Partners, and is reflected within our recently updated core values. We have been measuring and reporting on diversity and inclusion within Sarasin for the past two years. We have been incrementally reducing our gender pay gap, and we have targeted recruitment campaigns to address underrepresented demographics. However, we acknowledge there is more to be done.

In 2020, we established a Diversity & Inclusion taskforce comprised of colleagues from across the organisation. This represents the first stage of our commitment to promote a culture where all stakeholders are accepted as individuals and treated fairly and respectfully, and to improve diversity both within the firm and across the asset management industry. In the end, just as we believe your businesses will be more resilient and perform better by celebrating diversity, we know we have much to gain.

1Source: Diversity Wins - How inclusion matters, McKinsey, May 2020

2Source: Konrad, A. M., Kramer, V., and Erkut, S. 2008. The impact of three or more women on corporate boards. Organizational dynamics, 37(2), 145-64

3Source: Hampton-Alexander Review FTSE Women Leaders, Feb 2021

4Source: MSCI ESG Research Data - Mar 2021