Outlier events can upend models and instantaneously trigger new inflection points. Oil price shocks, asset price bubbles and monetary policy tightening have historically been the events triggering economic recessions.

Low probability but high impact events, like a pandemic, were not on the typical risk monitor. Yet, the health and economic calamity caused by the pandemic will continue to reverberate for years to come.

HOW CAN WE START TO ASSESS THE DAMAGE AND THE LIKELY PATH FORWARD?

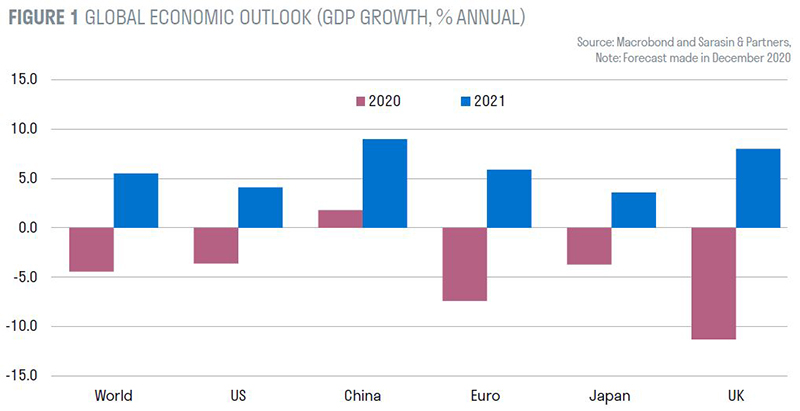

As a starting point, the damage is severe and tragically the human and economics costs continue to mount. The global economy is likely to have contracted by 4.4% annually in 2020 (Real GDP, in USD terms). By magnitude, that’s more than double the fall seen during the global financial crisis in 2009 (-1.7%). By region, the differences are stark.

China, which implemented the most severe restrictions, managed to supress the virus in a relatively short span of time. We forecast the Chinese economy grew by 2% in 2020 – the only major economy to post any economic growth. Large advanced economies, like the US and Japan, are likely to see their economies shrink by around 4%. In the euro area, which is grappling with a further surge of infections and the prospect of a double-dip recession, the contraction is likely to be 7.5%. In the UK, where Brexit uncertainty has compounded the pandemic-related economic costs, the total economic contraction will be higher still, at more than 11%.

THE ROAD AHEAD

The vaccine provides a bright ray of hope and largely underpins our positive economic outlook for 2021.

Crucially, it provides visibility for firms to make business investment decisions, and consumers with confidence to reduce high precautionary savings. Notwithstanding the logistical challenges for successful distribution, we expect the most vulnerable parts of society to be inoculated by the end of Q1 2021 in advanced economies, before the pace of vaccination accelerates to cover 75% of the total population by Q3 2021 – sufficient for herd immunity. As health outcomes improve, government restrictions will start to be rolled back from spring.

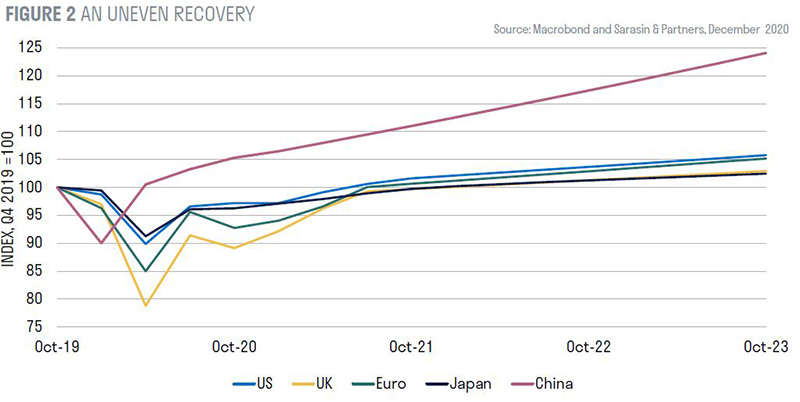

The mechanical re-starting of economic activity will see economic growth rates surge from Q2. But in comparison to the low base of 2020, this will generate statistical illusions that need to be carefully interpreted. The global economy is likely to record annual growth of 5.5% in 2021 – the fastest pace since the oil price shocks of the 1970s. However, this growth will reflect the fact that as much as 30% of the economy was forced to close during the height of the pandemic, rather than structural growth. Given the varying starting positions of countries, the time to fully regain lost economic ground will vary. The recovery will be uneven.

We expect the US economy, fuelled by fiscal-stimulus, will return to its pre-crisis size by Q3 2021, followed by the euro area and Japan towards the end of 2021, and the UK around a year later. So on average, countries will take 2-3 years to heal, while China completed this process in a single quarter.