Key points:

- Strong nominal growth and healthy corporate earnings are supportive of equities.

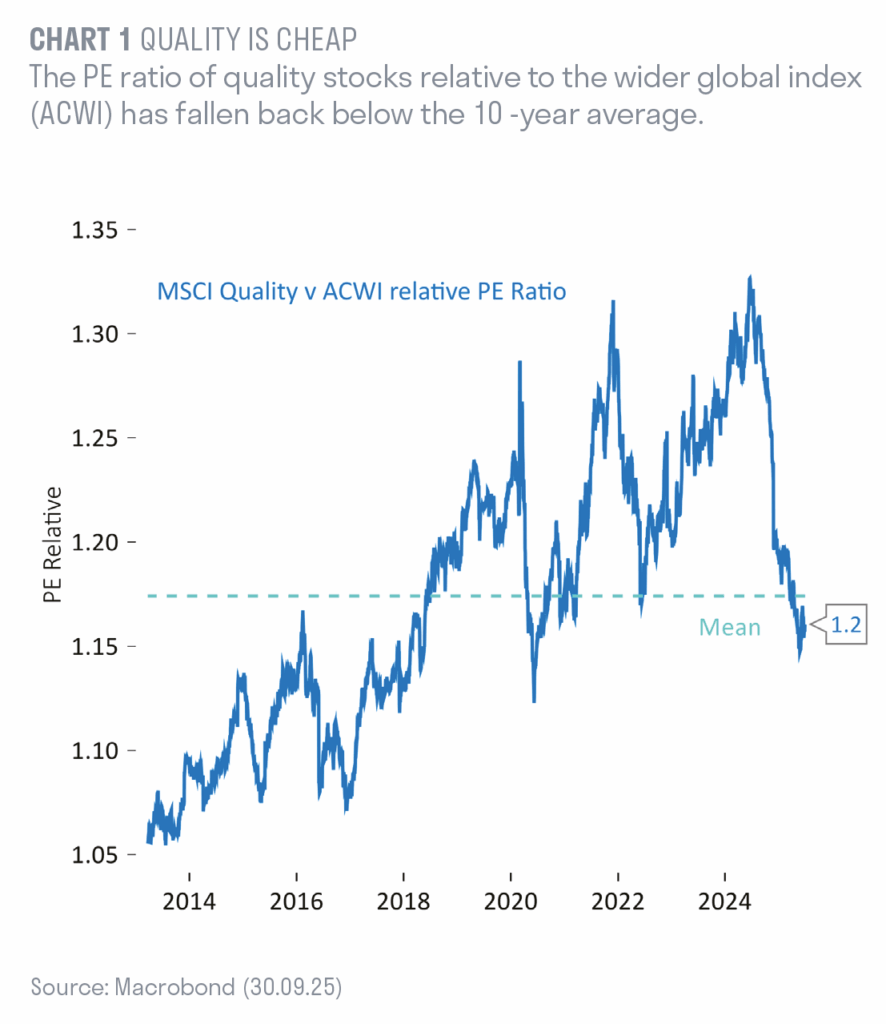

- Perceived lower-quality equities – those companies that exhibit weaker financial strength, less consistent profitability, and higher risk characteristics – have driven the market rally this year.

- We continue to focus on quality companies with higher returns on equity, stable earnings growth, and lower leverage, which we believe will deliver for long-term investors.

Global equity markets pushed higher again in the third quarter of the year, their sixth consecutive positive month (when measured in US dollar terms).[1] Europe has pushed past its previous peak back in 2000, while Japan’s peak in 1989 has finally been surpassed. We are overweight equities, and our individual holdings have tended to be higher quality. From our perspective, the reasons for this are clear: the long-term impact of tariffs, widening budget deficits, stubborn inflation, and unrelenting competition from China all continue to cloud the outlook for more cyclical and lower-quality earnings.

For now, markets have chosen to look past these concerns, with the strongest gains coming from high-beta (i.e. more volatile than the overall market) cyclical companies, unprofitable technology names, and financials. Retail investors have also continued to buy their favourites – Palantir, Tesla, and crypto-linked winners. The result has been an aggressive, liquidity-fuelled advance – one in which the more robust business models we tend to favour have lagged the wider market.

Our commitment to quality

That leaves us with a familiar choice: join the rush into high-beta, speculative equities, or stay disciplined with our quality, thematic holdings. We remain committed to the latter – defined as companies with high returns on equity, steady year-on-year earnings growth and low financial leverage. Encouragingly, the MSCI World Quality Index[2] has begun to show signs of recovery over the past month, even as risks build in the frothier corners of global markets (chart 1).

Core inflation remains sticky

Global growth remains broadly resilient, but core inflation is proving sticky. In the US, the economy is holding up well, and we predict growth of about 1.6% in both 2025 and 2026. Core inflation, however, remains elevated, with tariffs adding to cost pressures. This leaves the Federal Reserve’s preferred measure of inflation, the core PCE deflator (the Personal Consumption Expenditures Price Index), at 2.9%,[3] which is above policy makers’ 2% target for a fourth consecutive year.

That puts Federal Reserve Chair Jerome Powell in a difficult position: US labour markets are softening,[4] inflation is above target,[5] and political pressure from the White House for deeper rate cuts is mounting. We forecast two further rate cuts in the fourth quarter and one more in 2026 – though this is unlikely to satisfy the President’s newly appointed Governor, Steven Miran. He appears to favour a “fire-alarm” easing of up to 1.25 percentage points,[6] which would take the Fed Funds rate down to 3%.

China faces challenges

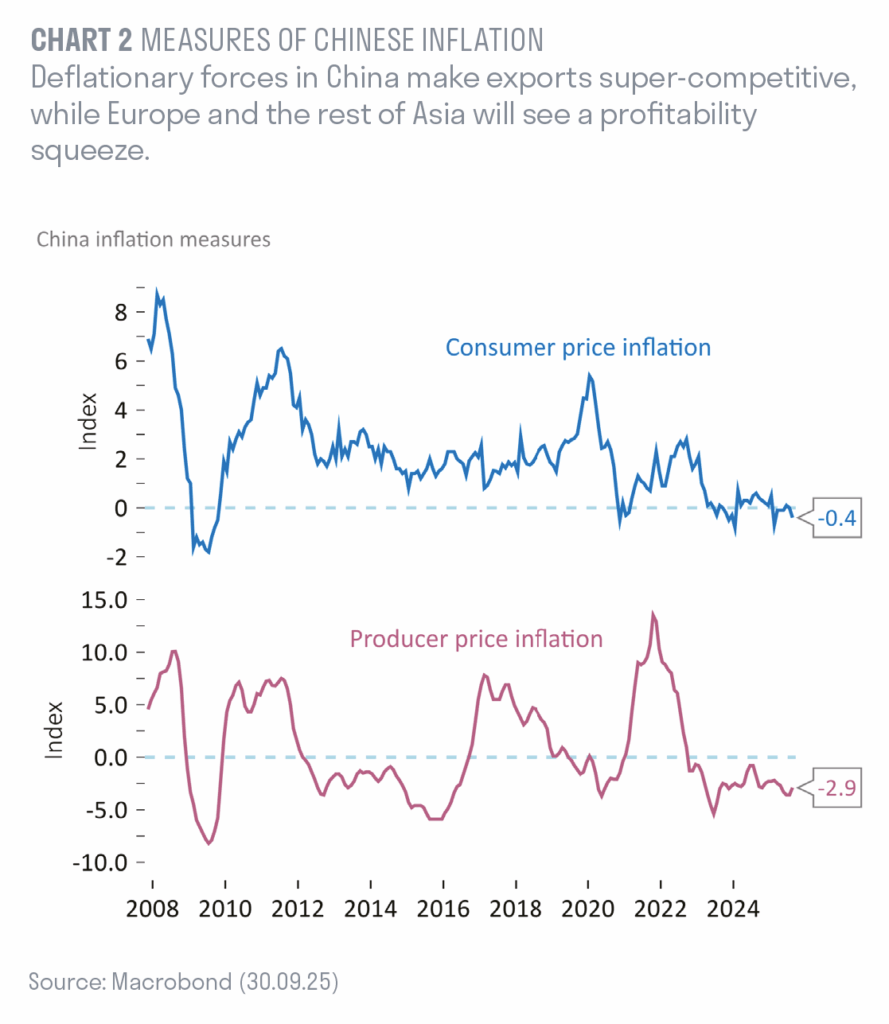

China faces a quite different challenge – but one that also argues for caution in equity selection. The economy continues to wrestle with structural deflation, centred on the property sector (chart 2). Consumer and factory-gate prices remain negative, and exports to the US have slowed. A further round of fiscal and monetary stimulus is likely in early 2026, albeit reluctantly adopted.

Meanwhile, cut-throat competition in many industries has compressed margins and left profits vulnerable even as the economy grows. This “excessive competition” – what Beijing terms involution – risks becoming a defining feature of China’s corporate landscape.

Europe’s domestic demand shift

In Europe, growth is softening as exporters work through orders brought forward to avoid US tariffs. Looking ahead, activity is likely to shift toward domestic demand, aided by higher defence spending. Headline inflation, at 2.2%, has remained relatively stable, though warning signs persist – German inflation surprised to the upside last month at 2.4%,[7] while core inflation across the Eurozone remains sticky at around 2.4%.

In short, the global economy looks set to muddle through 2026, but the outlook remains more challenging for cyclical sectors. Steepening yield curves, persistent Chinese competition, tariff spillovers, and sticky inflation all argue for robust business models and balance-sheet strength.

Could the UK be the canary in the coal mine?

In Britain, the Bank of England looks set to keep rates at 4% well into the new year, with core inflation at 3.6%[8] – still too high to allow meaningful easing. Growth should benefit from government spending and lower energy costs, but weak productivity remains a drag. All of this limits the Chancellor’s headroom as she prepares for the 26 November Budget – one that must respect fiscal rules without derailing Labour’s growth agenda.

UK bond markets are not wholly convinced. As of 6 October, ten-year gilt yields stood at 4.7%,[9] roughly 20 basis points above the worst days of the Liz Truss budget crisis, while 30-year yields were near 5.5%, a 25-year high that makes long-term funding expensive. Could the bond-market vigilantes return? Quite possibly. Yes, deficits are higher in France and the US, but the former can rely on ECB support, while the latter enjoys reserve-currency privilege.

As yield curves steepen and funding costs rise, the risk of a bond market shock grows. Any simultaneous de-risking of portfolios could hit the speculative assets that have led this year’s rally particularly hard. Hence our preference for maintaining a quality-focused portfolio.

Some signs of excess in global markets

While strong nominal growth underpins corporate profits, signs of excess are starting to emerge. September saw the largest leveraged buyout in history, as Silver Lake Management acquired Electronic Arts for $55bn.[10] The deal was led by President Trump’s son-in-law Jared Kushner and Saudi Arabia’s Public Investment Fund. Only a week earlier, Oracle issued $18bn of bonds to fund its cloud and AI expansion – an offering that was five time oversubscribed. Meanwhile, US margin debt – the bank borrowings used by retail investors to finance stock purchases – hit an all-time high of $1.06trn in August.[11]

Equity risk appetite is rising. The Wall Street Journal reports that a quarter of all new ETFs launched this year are leveraged funds,[12] which amplify both gains and losses. The largest “2x” single-stock ETFs now track Tesla, Strategy Inc and Nvidia. These funds use derivatives to double the already volatile daily move in the underlying stocks – up or down.

Taken together, record margin debt, surging leveraged loans and excessive risk-taking in derivatives all point to growing market exuberance. Once again, this underlines the case for a quality bias in equity selection, despite the frustration of lagging the more speculative market moves.

Watch for a reversal in momentum

The extraordinary rally in global equities following President Trump’s Liberation Day speech has been dominated by momentum trades, in other words the simple bet that recent winners will keep outperforming. Confidence in these trades has been reinforced by the President’s partial retreat from his harsher trade measures and by a widespread belief in a “Fed Put” – that the central bank will accelerate rate cuts if growth slows or markets falter.

In 2025 nowhere is momentum more evident than in AI-related stocks – these stocks are up significantly.

At Sarasin, we selectively own profitable quality tech stocks as a key part of our thematic approach. It is fair to say though that many investors have begun to assume continuous, consensus-beating earnings as a given. Indeed, we have rarely seen such prodigious cash-flow growth alongside such vast investment in data-centre infrastructure worldwide.

Overweight equities but remaining selective

Despite the signs of exuberance, the fundamental underpinnings of global equities remain sound. Consensus forecasts point to around 13% earnings growth over the next 12 months, while global dividends are expected to rise by almost 10%, in addition to near-record US share buybacks. Yes, valuations are high, but profitability and cash generation remain robust.13

A further re-rating may be possible in the aftermath of the tentative settlement in Gaza. Our positioning therefore is overweight equities, but with a continued focus on companies with higher returns on equity, stable earnings growth, and lower leverage. This approach may lag the market in exuberant phases, but we are confident it will reassert itself in the long run.

[1] https://www.trustnet.com/news/13459764/seven-charts-that-show-how-markets-moved-across-2025s-third-quarter

[2] https://www.msci.com/documents/10199/255599/msci-world-quality-index.pdf

[3] https://www.bea.gov/data/personal-consumption-expenditures-price-index-excluding-food-and-energy

[4] https://www.bls.gov/

[5] https://www.bls.gov/news.release/cpi.nr0.htm

[6] https://www.msn.com/en-us/money/markets/steve-miran-was-the-only-fed-governor-to-vote-for-a-deeper-rate-cut-after-this-week-s-decision/ar-AA1MVdfp?ocid=finance-verthp-feeds

[7] https://www.destatis.de/EN/Themes/Economy/Prices/Consumer- Price-Index/_node.html

[8] https://www.bankofengland.co.uk/monetary-policy/inflation

[9] https://markets.ft.com/data/bonds/tearsheet/summary?s=UK10YG

[10] https://news.ea.com/press-releases/press-releases-details/2025/ EA-Announces-Agreement-to-be-Acquired-by-PIF-Silver-Lake-and- Affinity-Partners-for-55-Billion/default.aspx

[11] https://www.finra.org/rules-guidance/key-topics/margin-accounts/ margin-statistics

[12] https://www.wsj.com/finance/investing/etfs-are-flush-with-new-money-why-billions-more-are-flowing-their-way-8d9cbfb7

[13] Macrobond, to 30.09.25

Important information

This document is intended for retail investors and/or private clients. You should not act or rely on this document but should contact your professional adviser.

This document has been issued by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England and Wales with registered number OC329859, and which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance.

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2025 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact marketing@sarasin.co.uk.