The geopolitical landscape is undergoing a profound transformation. US hegemony, which followed the end of the Cold War, is giving way to an unbalanced multipolar world.

China's rapid economic and military rise is creating a new ‘pole’, while other emerging nations are charting their own independent courses. The implications of this power shift are far-reaching and will impact financial markets.

From Cold War to US hegemony

The Cold War era (1947-1991) was dominated by two superpowers, the US and the Soviet Union, which maintained distinct but separate spheres of influence. This bipolar world order was surprisingly stable as the threat of a nuclear conflict between the two superpowers kept war at bay. With the collapse of the Soviet Union in 1991, the world gradually transitioned to a unipolar power structure within which the US emerged as the dominant force in markets, finance, technology, and military affairs.

As the sole hegemon, the US has been a leading architect of a rules-based system of global governance administered through multilateral institutions like the UN, NATO, WTO and the IMF. These institutions are embedded within both the western cultural values of democracy and human rights, and economic values such as co-operation and open markets. This became the platform for an increasingly efficient and interconnected global economy that raised living standards across the world. US allies benefited from a 'peace dividend' as fears around major conflicts ebbed; the US in turn reaped a 'power dividend', expressed most obviously through the dominance of the US dollar and the US financial system in international capital flows.

Over the past two decades, China has strategically capitalised on open trading markets to propel itself to the forefront of economic and military power, and is keen to gain a correspondingly bigger say in global governance. At the same time, there is a growing consensus within the US that the rules-based international order has contributed to negative domestic impacts like deindustrialisation and growing inequality, and should be reformed.

The multipolar world takes shape

As China, India and other emerging markets continue to grow, the global power balance is drifting away from the US. China’s tacit support for Russia’s war in Ukraine, its belligerence in the South China Sea, and the One Belt One Road initiative, are all efforts to chip away at US dominance and challenge its status as a sole hegemon.

At the same time, growing emerging powers, such as India, Turkey, Brazil, Vietnam, Saudi Arabia, and the UAE, are resisting calls to align with either the emergent Chinese pole or the incumbent US pole. Instead, they are pursuing their own national interests and forming flexible alliances depending on the issue at hand. As a result, the global power structure is likely to be much more decentralised than during the Cold War era: we expect two opposing poles accompanied by a multitude of alliances leading to a more complex, dispersed geopolitical structure.

Friction, flashpoints…

China has assembled a loose coalition of mostly authoritarian allies – Iran, Russia and North Korea – which are seeking to subvert US dominance. Hostile rhetoric and tit-for-tat sanctions reveal hardening positions. At the current trajectory, the likelihood of a confrontation, with Taiwan emerging as a potential flashpoint, is increasing. An end game where China establishes indirect control over Taiwan, with the US potentially backing down to avoid direct conflict, has gone from unthinkable to plausible.

A gradual retreat by the US from its role as a global policeman is likely to make the geopolitical environment much more uncertain and insecure. Progress on nuclear non-proliferation has started to reverse and technologies, such as AI and cheap missile and drone swarms, are injecting huge uncertainty into outcomes of potential conflicts.

...lead to fragmentation

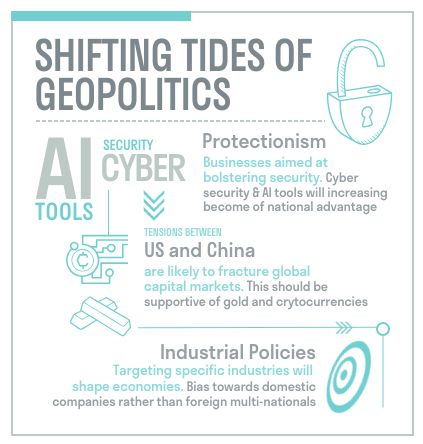

In an increasingly rivalrous global economy, countries are adopting protectionist measures to bolster their strategic advantage. Motivations include safeguarding critical supply chains, shielding domestic industries from foreign competition and addressing trade imbalances. Since 2012, advanced economies have led the way by increasing their use of trade barriers and industrial policy tools.

Over the next decade, we expect the globalised marketplace for goods and services to fragment further as tariffs, subsidies, import licensing requirements, anti-dumping duties, and trade sanctions, all aimed at protecting domestic industries and reducing reliance on foreign supply chains, become more common place.

As global power shifts away from the US, the integrated global financial system it supported is also likely to splinter. Financial integration under US hegemony has been accompanied by ‘dollar dominance’ where the currency’s role in global payments and settlements (circa 80%) is substantially larger than its share of Global GDP (circa 25%) and US Treasuries have become the de facto global 'safe asset'.

Escalating US-China rivalry is making investors wary of cross-border operations. Many financial institutions have begun to scale back operations in jurisdictions that could one day be exposed to sanctions from western governments. Global banks and investment firms, which had poured hundreds of billions into China over the past decade, have been scaling back future investment plans. Chinese companies are revisiting US listing plans over fears of heightened scrutiny from both the China Securities Regulatory Commission (CSRC) and the Public Company Accounting Oversight Board (PCAOB) in the US.

Market implications

The shift away from a US-centric globalised system, coupled with the rise of protectionism and the potential for conflict, is recalibrating both the risks and opportunities in financial markets. We believe there are three main risks to be considered:

- First, US reluctance to provide iron clad defence guarantees for global security, alongside the growing impatience of the China-led alliance with the status quo, increases the risk of global conflict.

- Second, the growing use of tariffs and industrial policies alongside bigger defence budgets will raise inflation, increase volatility, and worsen fiscal sustainability; this is likely to result in upward pressure on bond yields.

- Third, rising tension between the incumbent US pole and the emergent Chinese pole is likely to fracture global capital markets. Capital controls and sanctions are likely to become more pervasive, leading to a gradual erosion of dollar dominance.

These changes are also driving a range of investment opportunities:

- Defence, cyber, and security spending will experience a sustained increase, benefiting earnings and valuations for companies operating in these industries. Heightened uncertainty also supports the inclusion of tail risk protection within investment strategies.

- Strategic autonomy is becoming a higher priority across the world, with positive implications for investments in 'strategic resources' such as metals, agricultural products, and elements critical for industrial production.

- Similarly, the political imperative for shorter supply chains and stronger 'national champions' can have a range of positive impacts for domestically focused companies. This includes subsidies, more permissive regulation, and toleration of oligopolistic behaviour – with potential beneficiaries ranging from large US tech platforms to European utilities.

- Finally, a lessening of dollar dominance could be hastened by moves to use sovereign wealth funds to diversify government reserves, favouring 'trophy' assets and dollar alternatives, such as gold, and potentially even bitcoin.

Conclusion

In this new era of multipolarity, it is crucial that investors anticipate and adapt to the shifting tides of geopolitics, effectively managing the inherent risks and capitalising on the opportunities associated with a more complex and volatile landscape.

This document is intended for retail investors in the US only. You should not act or rely on this document but should contact your professional adviser.

This document has been prepared by Sarasin & Partners LLP (“S&P”), a limited liability partnership registered in England and Wales with registered number OC329859, which is authorised and regulated by the UK Financial Conduct Authority with firm reference number 475111 and approved by Sarasin Asset Management Limited (“SAM”), a limited liability company registered in England and Wales with company registration number 01497670, which is authorised and regulated by the UK Financial Conduct Authority with firm reference number 163584 and registered as an Investment Adviser with the US Securities and Exchange Commission (“SEC”) under the Investment Advisers Act of 1940. The information in this document has not been approved or verified by the SEC or by any state securities authority. Registration with the SEC does not imply a certain level of skill or training.

In rendering investment advisory services, SAM may use the resources of its affiliate, S&P, an SEC Exempt Reporting Adviser. S&P is a London-based specialist investment manager. SAM has entered into a Memorandum of Understanding (“MOU”) with S&P to provide advisory resources to clients of SAM. To the extent that S&P provides advisory services in relation to any US clients of SAM pursuant to the MOU, S&P will be subject to the supervision of SAM. S&P and any of its respective employees who provide services to clients of SAM are considered under the MOU to be “associated persons” as defined in the Investment Advisers Act of 1940. S&P manages mutual funds in which SAM may invest its clients’ assets as appropriate.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance. Management fees and expenses are described in SAM’s Form ADV, which is available upon request or at the SEC’s public disclosure website, https://www.adviserinfo.sec.gov/Firm/115788.

Neither Sarasin & Partners LLP, Sarasin Asset Management Limited nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement.

The index data referenced is the property of third-party providers and has been licensed for use by us. Our Third-Party Suppliers accept no liability in connection with its use. See our website for a full copy of the index disclaimers https:// sarasinandpartners.com/important-information/.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2024 Sarasin Asset Management Limited – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin Asset Management Limited. Please contact marketing@sarasin.co.uk.