Key points:

- A company’s revenue streams and cost profile, not its geographical listing, define its currency risk.

- For multi-asset portfolios, investors must also consider the implications of commodities being priced in dollars.

- Investors can manage currency risk through hedging strategies, but these are an imperfect solution with both pros and cons.

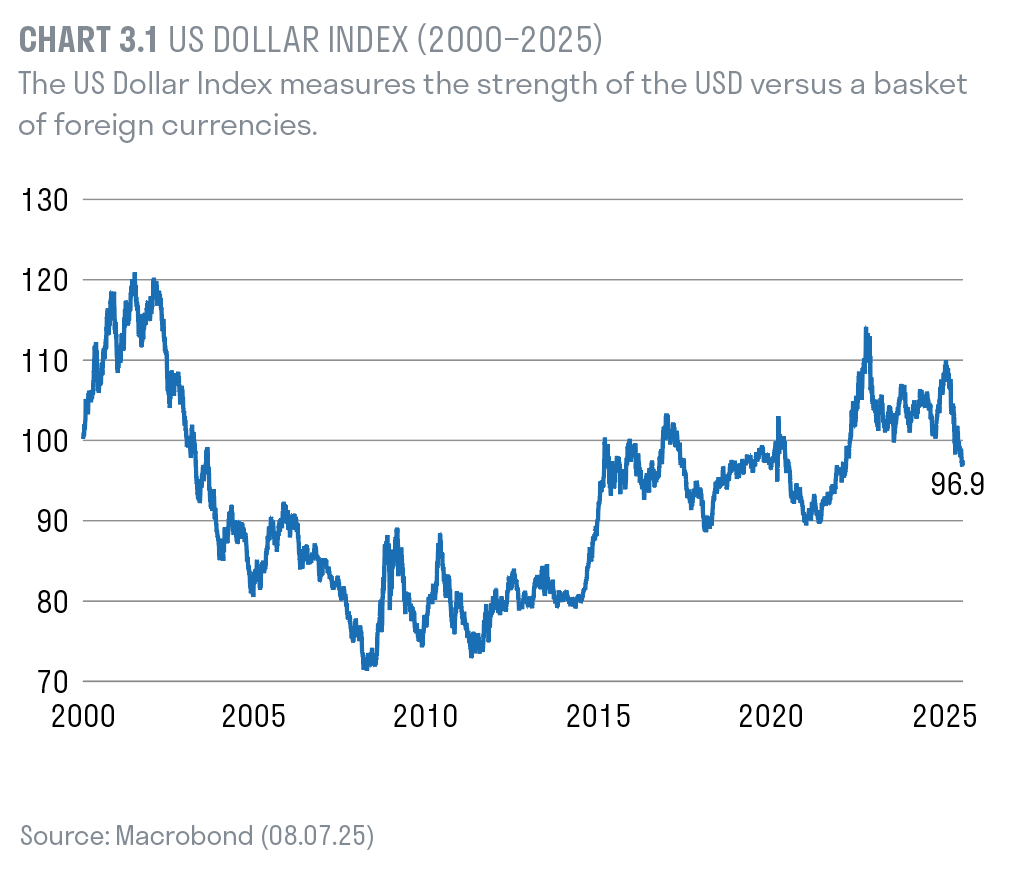

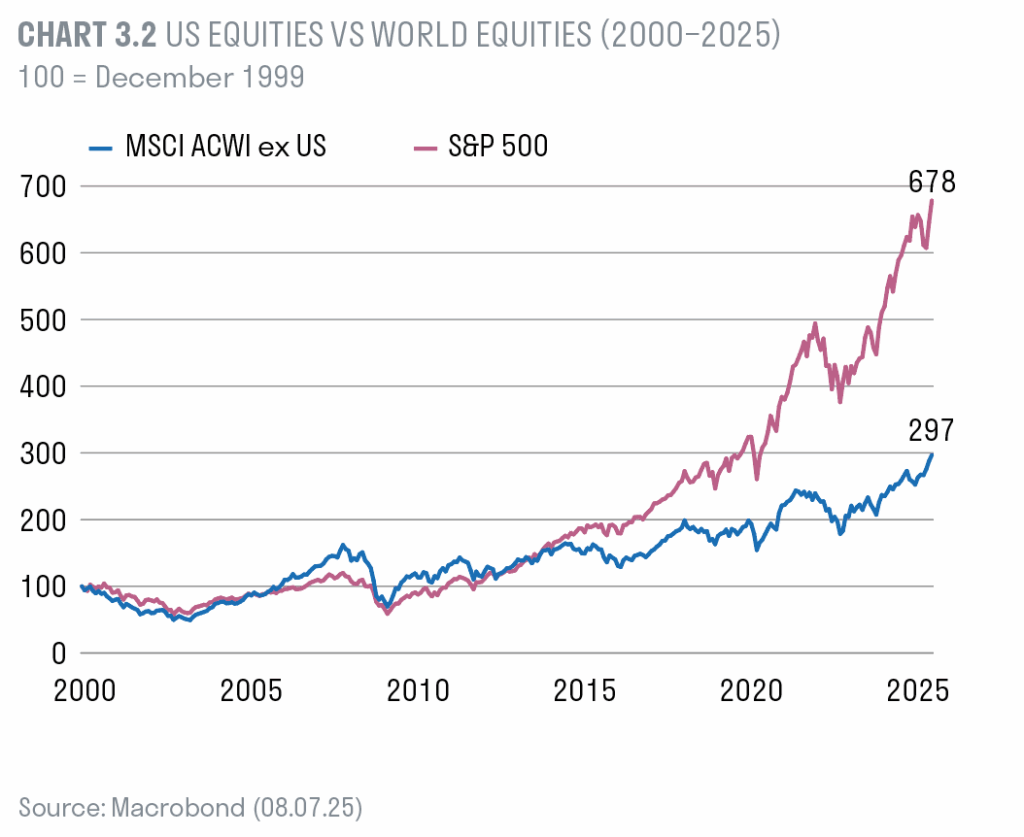

For much of the past 15 years, the US dollar has been strengthening steadily relative to other currencies. The dollar’s role as the world’s reserve currency has been a source of strength, compounded by the notion of ‘US exceptionalism’ as US equity markets have outpaced their peers over the long term, in particular due to the dominance of US listed global technology stocks. Indeed, the S&P 500 hit fresh record highs in June 2025.[1]

However, we may be at a turning point for the dollar as explained in Subitha Subramaniam’s article. In this article, we will explore how currency fits into investment decision making. At a stock level, we will look at considerations for companies when importing and exporting goods, the role of commodities priced in dollars, and how we at Sarasin & Partners manage currency risk.

Currency exposure is about more than where a company is listed

A common misconception is that the geographic listing of a company equates to its currency exposure. For instance, it may be assumed that a UK-listed FTSE 100 company that reports in pounds sterling (GBP) is currency neutral for a UK investor. In reality, a company’s revenue streams and cost profile define true currency risk.

For example, a company like Compass Group, although listed in London, earns a significant portion of its revenues across the world in US dollars and euros. As such, a UK investor buying Compass Group is indirectly taking on multi-currency exposure, which must be considered as part of the stock’s overarching investment thesis.

This was notably demonstrated in the aftermath of the Brexit referendum, a period in which sterling depreciated rapidly. While the outlook for the domestic economy looked uncertain, counterintuitively, the FTSE 100 had a very strong year. This was down, in part, to the global nature of the companies within the index and the translation effect of currency. Multinational companies generating overseas revenues were not only insulated from the weakened domestic outlook, but benefited from sterling weakness as revenues generated overseas in other currencies were consequently worth more in sterling terms.

The same effect is felt elsewhere in the world. For example, lift manufacturer Otis Worldwide is listed on the New York Stock Exchange, but c.70% of its revenues were generated outside the US last year, notably in China and Latin America.[2] In this case, a weakening dollar is positive for the company’s return profile as it means the local emerging market currencies are worth more in dollar terms. When the company converts foreign earnings back into dollars, this may boost potential revenue and profit in its financial statements.

Exporters vs importers

Currency fluctuations can significantly impact a company’s bottom line, depending on whether it is a net exporter or importer.

US exporters benefit from a weak dollar relative to other currencies. A weaker dollar not only means overseas revenues translate into more dollars upon repatriation, but it also improves their competitiveness in global trade.

As a net exporter, China benefits when its currency is weak. Historically, a weak Chinese yuan has even been a source of tension between the US and China, often cited as a catalyst to the growing trade deficit. Such is the importance of currency, President Donald Trump has previously accused China of currency manipulation.[3]

US importers, such as retailers like Walmart and The Home Depot, prefer a strong dollar. They pay suppliers in foreign currencies, and a stronger dollar makes those purchases cheaper, thereby improving margins.

Further currency complexity is added when companies import raw materials to build a finished product for export.

Many of these will use currency hedging strategies to manage this risk. These activities all feed into the fundamental analysis of an investment opportunity. It is important to assess how a company's supply chain and customer base interact with currency movements. A well-constructed portfolio will have a diverse array of companies that will benefit from varying currency movements.

Commodities: priced in US dollars

A well-diversified portfolio needs to account for the impact of the US dollar on commodity markets. Commodities such as gold, oil, wheat, and industrial metals are typically priced in US dollars.

When the dollar weakens relative to other currencies, commodities become cheaper for foreign buyers, often increasing global demand, thereby potentially pushing prices up. So, it is possible that commodity markets may rise purely on the back of a weakening dollar – though, in reality there are many other variables at play.

However, if, for example, the price of gold rises in an environment with a weak dollar relative to sterling, the gain for a sterling investor may be partially or fully offset.

How we manage currency risk

At Sarasin & Partners, we manage currency risk in three key ways:

- Currency is a crucial consideration when researching the risks and key drivers of each individual security within a portfolio.

- Currency diversification is important. However, where our bottom-up security selection process has naturally introduced significant currency risk in multi-asset portfolios, we will implement a hedging strategy suitable to the needs of the underlying client.

- We regularly review our hedging policy, considering currency valuations and underlying economic activity to ensure it aligns with a portfolio’s strategic objectives.

We approach currency hedging at the overall portfolio level rather than on a stock-by-stock basis. Generally speaking we believe a broad exposure to global currencies is important for diversification, recognising that over the medium to longer term, currency movements should have less of an impact if foreign exchange is incorporated correctly into the longer term investment thesis.

However, we remain alert to changes within the economic landscape that might affect companies. We implement our currency hedging via over-the-counter (OTC) three-month forward contracts, to provide us with flexibility without introducing significant costs. A forward contract is an obligation today to buy or sell something in the future –in this case an asset priced in a specific currency – at a price you both agree on now. This is the industry standard method of currency hedging, though it does not remove relative currency risk.

Given the complexity of currency’s impact on a company’s return profile, currency hedging is an imperfect art. See the box on this page for the main pros and cons of incorporating a hedging strategy.

The pros and cons of currency hedging

Advantages:

- Reduces currency risk: helps protect the value of international investments from adverse currency movements.

- Can provide greater certainty: reduces volatility from exchange rate fluctuations, which can smooth investment performance.

- Improves strategic focus: allows investors to focus on underlying asset performance without being

distracted by currency moves.

Disadvantages:

- Cost considerations: hedging strategies can incur costs depending on interest rate differentials.

- Opportunity cost: if a foreign currency strengthens, hedging may prevent the investor from benefiting.

- Basis risk: hedging may not perfectly match the currency exposure (e.g. due to timing or imperfect instruments), leading to residual risk.

To hedge or not to hedge

For global investors, currency is a crucial – if sometimes underappreciated – piece of the investment puzzle. While we have sought to highlight some of the key considerations around currency, whether or not to hedge exposure (and to what degree) depends on a client portfolio’s objectives and requirements. There is no one-size-fits-all solution.

The right approach depends on your investment objectives, time horizon, risk tolerance and potential liabilities. Ultimately, as a long-term global investor, we tend not to make extreme over or underweight allocations, but will often bring currencies to benchmark weights in the run-up to a major regional political event. There will be times when hedging sterling will be beneficial and other times when it will have a negative impact. As investment managers, we see hedging as a risk management tool, as well as an area where, at times, we can add value tactically.

In recent years, we have embraced the opportunities afforded to global investors, and have organically built up meaningful exposure to the US equity market, and as a consequence dollars, across most portfolios. This has meant we have benefited from both the strength of the US market

as well as a strong dollar in times of economic uncertainty. More recently, however, we have reduced our overweight dollar exposure in many portfolios to a more neutral strategic weighting.

As global dynamics shift, and the economic landscape around us evolves, we continue to analyse the prevailing environment and potential implications of US policy, incorporating direct and indirect currency exposure into our investment analysis and portfolio construction.

[1] https://www.nytimes.com/2025/06/27/business/sp-500-record-trump.html

[2] https://www.otis.com/documents/d/otis-2/otis-annual-report

[3] https://edition.cnn.com/2019/08/05/business/china-currencymanipulator-donald-trump

Important information

This document is intended for retail investors and/or private clients in the US only. You should not act or rely on this document but should contact your professional adviser.

This document has been prepared by Sarasin & Partners LLP (“S&P”), a limited liability partnership registered in England and Wales with registered number OC329859, which is authorised and regulated by the UK Financial Conduct Authority with firm reference number 475111 and approved by Sarasin Asset Management Limited (“SAM”), a limited liability company registered in England and Wales with company registration number 01497670, which is authorised and regulated by the UK Financial Conduct Authority with firm reference number 163584 and registered as an Investment Adviser with the US Securities and Exchange Commission (“SEC”) under the Investment Advisers Act of 1940. The information in this document has not been approved or verified by the SEC or by any state securities authority. Registration with the SEC does not imply a certain level of skill or training.

In rendering investment advisory services, SAM may use the resources of its affiliate, S&P, an SEC Exempt Reporting Adviser. S&P is a London-based specialist investment manager. SAM has entered into a Memorandum of Understanding (“MOU”) with S&P to provide advisory resources to clients of SAM. To the extent that S&P provides advisory services in relation to any US clients of SAM pursuant to the MOU, S&P will be subject to the supervision of SAM. S&P and any of its respective employees who provide services to clients of SAM are considered under the MOU to be “associated persons” as defined in the Investment Advisers Act of 1940. S&P manages mutual funds in which SAM may invest its clients’ assets as appropriate. To the extent that SAM is able to exercise proxy voting on behalf of its clients, SAM follows the policy set by S&P. Proxy voting is an operational process dependent upon support from SAM’s clients’ custodians, some of which do not support proxy voting in all or certain markets.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance. Management fees and expenses are described in SAM’s Form ADV, which is available upon request or at the SEC’s public disclosure website, https://www.adviserinfo.sec.gov/Firm/115788.

Neither Sarasin & Partners LLP, Sarasin Asset Management Limited nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2025 Sarasin Asset Management Limited – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin Asset Management Limited. Please contact marketing@sarasin.co.uk.