Key points:

- Equity markets remained remarkably resilient in 2025, while credit spreads narrowed to near historic lows.

- Despite high valuations and an extraordinary geopolitical backdrop,

we believe equity markets can continue to climb higher with five key

strategies for 2026. - We have remained overweight equities – with a focus on high-quality, defensive stocks – and gold and other alternatives, while staying cautious on bonds and credit.

After the extraordinary events of 2025, can the resilience of risk assets stretch into 2026?

The past 12 months have delivered an extraordinary sequence of geopolitical shocks, many of them coming directly or indirectly from the Trump White House. They began in April last year with the announcement of the highest US tariffs in 80 years and culminated in early January in the capture and arraignment of Venezuelan President Nicolás Maduro.

In almost every instance (including even the bombing of Iran’s missile bases), risk assets have rallied. This leaves global equities and gold at new highs, while corporate bond spreads trade near record lows. Both the dollar and oil have fallen. This combination of returns (gold aside) is almost the exact opposite of what one might expect in a world of elevated geopolitical risk.

How, then, should investors interpret this? Do they see Mr Trump as a peacemaker – and the most pro-business, pro-deregulation president in decades – or a hyper-active president whose policies, combined with mounting exuberance in the AI complex, argue for caution?

Reflecting on 2025

What made 2025 unusual was not merely the scale of the market rally following President Trump’s Rose Garden speech of 2 April, but its breadth. After a weak start to the year equities rose strongly across both developed and emerging markets, while credit spreads narrowed to near historic lows. Gold surged by 70%, its strongest performance since 1979 – silver and copper also rallied strongly.[1]

Over the year, the US dollar fell sharply (-9% for the dollar index), in a move that has historically favoured international markets. This relationship held again in 2025, with global equities outperforming US equities by more than 10% – and close to 15% once currency effects are included. So yes, although the MAG7 and other AI beneficiaries rose, this was not a year in which US exceptionalism dominated markets.

Our strategy

Our asset-allocation team has maintained an overweight to equities, funded by reductions in bonds and cash. In balanced portfolios, we added modestly to alternatives, with continued emphasis on gold, absolute return strategies and emerging market debt. We have held our underweight to the dollar (hedging a proportion of our US equity exposure), while continuing to minimise our direct and indirect exposure to oil.

While our asset allocation worked well in 2025, the greater challenge for us has been within equities themselves. Our positioning here has been overly cautious and defensive, with too strong a focus on quality. The result is that although our equity funds delivered positive absolute returns, they have notably lagged global indices. Yes, our thematic process provided exposure to semiconductors, defence and banks – among the year’s best-performing sectors – but we needed to have held more across portfolios.

We also maintained a near-index weight in the US market, given the unique thematic qualities of so many American companies. This, though, leaves us with a higher dollar exposure than many of our competitors. We have hedged a portion of our US equities back into sterling, but this has still been a notable drag on returns.

Looking ahead

So, will this quality-based equity strategy work in 2026? To answer this, let’s look first at nominal GDP growth, which should remain solid across most developed and emerging economies in 2026.

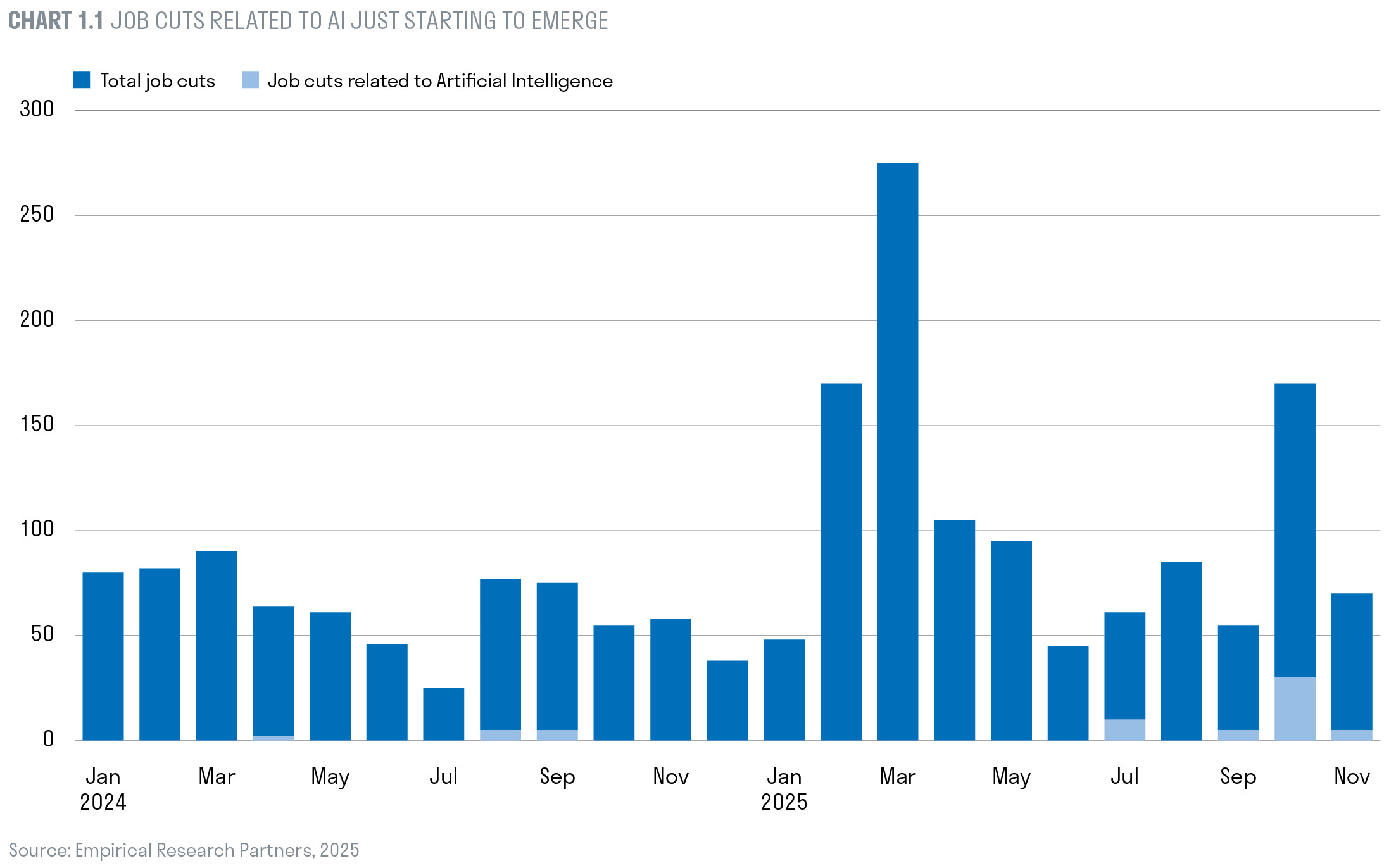

We believe, the US economy in particular is likely to accelerate as last year’s headwinds turn into tailwinds. Trade-policy uncertainty is easing, fiscal policy is becoming more expansionary, and AI adoption is spreading across sectors. Modest gains in productivity (AI-led) and soft hiring should allow the Federal Reserve to remain accommodative (AI linked job losses are just starting to emerge – Chart 1.1).

Other major advanced economies including the UK, Japan and Europe should also continue to see robust nominal GDP growth, with private sector spending recovering and government spending growth showing no signs of letting up. The UK Budget delivered government spending that is front-loaded, and tax rises that will be felt only in 2028-29. The key challenge for the UK and Europe is not spending but productivity growth.

China, by contrast, is set to rely more heavily on fiscal policy as it grapples with a prolonged property downturn and rising external pressures. With limited room for further monetary easing, policymakers are turning increasingly to targeted government spending to support activity. Expect an aggressive export strategy to non-US markets to continue – with Europe particularly exposed.

So, how will central bankers react against this backdrop?

We expect financial conditions to remain accommodative, with further rate cuts likely in 2026 in both the UK and the US. This suggests that the major central banks are going to allow economies to “run hot” in 2026, with the Federal Reserve becoming potentially more dovish as Trump-influenced

appointments steadily grow. For investors, this policy mix is broadly supportive of equities and real assets, even if it means inflation remains above central-bank targets for a sixth year running.

Geopolitics: a philosophy of “might is right”, but still broadly market-friendly

Mr Trump entered his second term of office promising to be a peacemaker. In practice, he has shown a readiness to use force. Beyond the capture of President Maduro, he has authorised air strikes in Syria and Nigeria, targeted nuclear facilities in Iran, attacked suspected drug-trafficking vessels in the Caribbean, and struck rebel forces in Yemen, armed groups in Somalia and Islamist militants in Iraq.

In most cases, though, markets have tended not to be too concerned. Either the economic impact is judged negligible, or the interventions themselves create commercial opportunities. Venezuela is the starkest example. Despite sitting on the world’s largest oil reserves, it produces barely one million barrels a day, down from four million in 1974.[2] Years of corruption, neglect, fires and theft lie behind the collapse. If the Trump White House can begin to access these reserves for global markets, investors will likely look through the geopolitical aggression.

Taken together, White House policy argues for a world of geopolitical fragmentation, where international institutions are weakened as larger countries seek to carve out their respective spheres of influence. The impact on markets will, for the present, be surprisingly muted.

Market risks

Against this backdrop, there is clearly the risk of a reassessment of the potential of AI in the global economy.

This would likely be coupled with a delay in the pay-back forecast on the vast data-centre projects we are seeing emerge around the world. However, we think that AI-related activity will still only account for a little under half

of US GDP growth in 2025. Contrary to the claims by some commentators, the large diversified US economy would not be in recession without it. You can read more about this, as well as a contextual history on the development of AI, in Adam Hamilton’s article.

Another trigger for a correction could be a sharp technical sell-off in the MAG7 and other AI beneficiaries. Valuations are certainly high, and investors are starting to worry about rising borrowings to fund data-centre construction. However, among the largest AI ‘hyperscalers’ (Google, Microsoft, Amazon and Meta), free cash flow is expected to rise to a staggering $240bn in 2026, while their debt-to-equity ratio climbs to just 30%.[3]

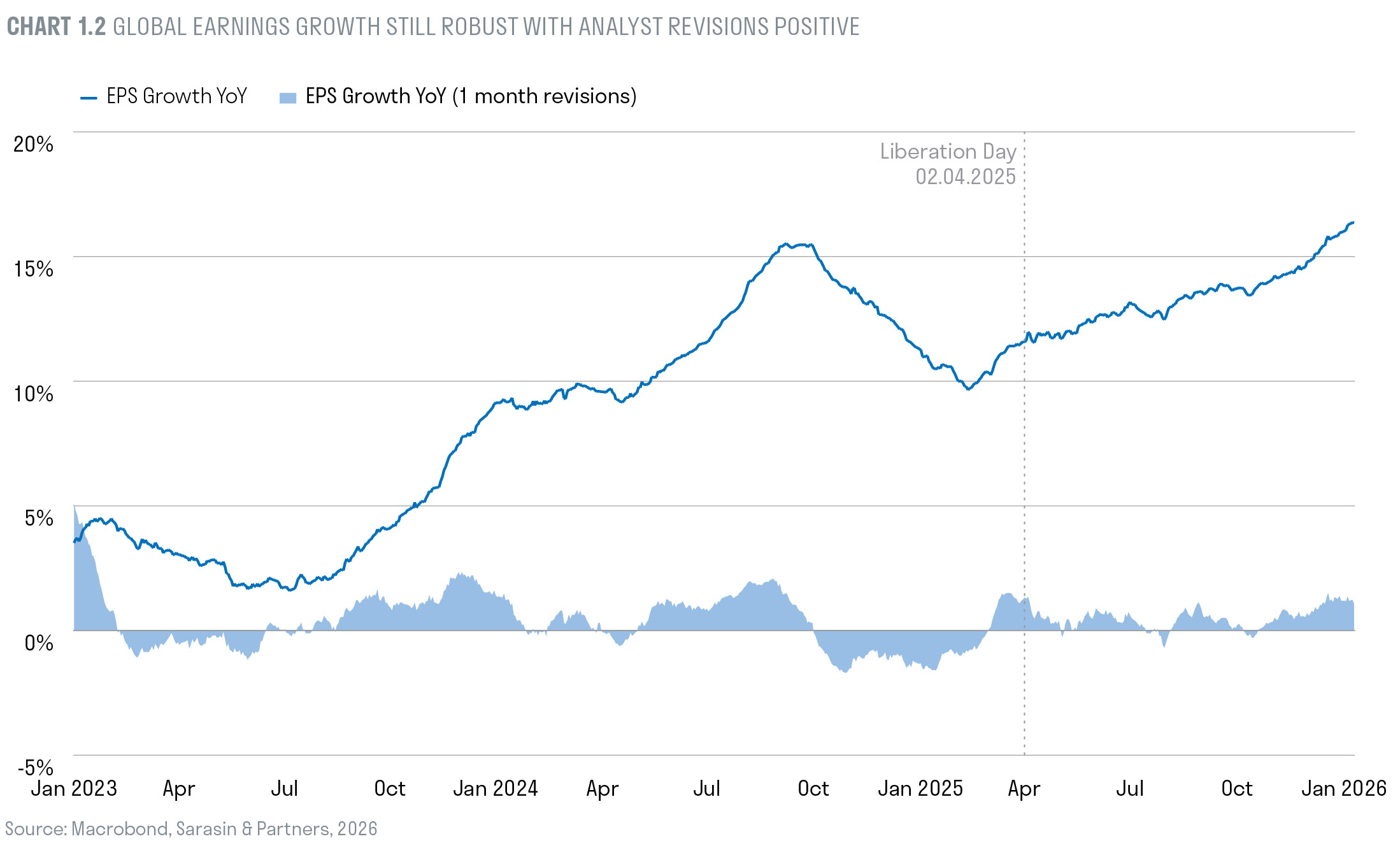

More generally, global earnings are forecast to rise by around 16% in the year ahead and revisions are positive (Chart 1.2) – this acts as a fundamental support to today’s equity valuations.

A further risk comes from the bond markets in the face of public borrowing that remains high, and mostly unchallenged. So far though bond markets seem to be looking through this with the US 10-year treasury yield falling over recent months, and UK gilt yields also lower. In short, the bond market vigilantes seem to be biding their time but as the pressures of an ageing population, rising defence spending and climate worsen they may yet reappear.

So, what are the winning strategies for 2026?

Against this backdrop, we see five key opportunities for global investors as they look to 2026.

- The world is becoming more competitive and rivalrous, and tariffs and sanctions will grow. Investors should focus on national champions across equity markets and add to strategic assets (including metals, semiconductors and even food). The dollar will tend to weaken further as China and other surplus countries seek to diversify their reserves away from the US currency.

- The US is less willing to underwrite global security. Defence and cyber spending will rise sharply as Europe and Asia dramatically accelerate their military spending. Companies involved in cyber security, missile-defence systems, drones and space satellite-based industries should all benefit.

- Government spending on ageing populations, climate

and defence will continue to rise. Expect higher bond yields, but also opportunities for banks (which benefit from rising long rates), alongside gold and, in the longer term, crypto assets. - Less efficient supply chains, rising power demand for AI and growing climate risks all argue for higher and more volatile inflation. Investors should favour real assets (equities and commodities), power generation, transition metals and other beneficiaries of the AI buildout, as every major country or region seeks its own large language model (LLM) capabilities.

- As AI diffusion gathers pace, productivity will start to pick up and an era of extraordinary innovation will unfold. Expect growth in robotics, self-driving and robotaxis, improved drugs and even nuclear fusion. Service industries will require fewer workers but could reap substantial productivity gains.

In short, quality thematic growth should work in 2026 - focusing on robust returns on equity, high margins and lower leverage remains a prudent way of managing a thematic portfolio that is rich in opportunity but faces unique

geopolitical risks. In response, we have remained overweight equities, gold and other alternatives, while staying cautious on bonds and credit.

Our challenge, though, has been our high-quality, defensive equity strategy, which lagged market indices materially in 2025. Looking at the risks ahead, but also at the opportunities, we feel confident in how we are positioned for 2026.

[1] Marcrobond, 2025

[2] https://www.msn.com/en-us/money/markets/why-venezuelastruggles-

to-produce-oil-despite-having-the-world-s-largestreserves/

ar-AA1TDEwV

[3] Empirical Research Partners, 2025

Important information

This document is only intended or retail investors/and or private clients who are US persons. You should not act or rely on any information contained in this document without seeking advice from a professional adviser.

This is a marketing communication. Issued by Sarasin Asset Management Limited (“SAM”), Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU. Registered in England and Wales, No. 01497670. Authorised and regulated by the UK Financial Conduct Authority (“FCA”) (FRN: 163584). Registered as an Investment Adviser with the US Securities and Exchange Commission under the Investment Advisers Act of 1940, as amended (CRD No. 115788/SEC No. 801-62077). Website: www.sarasinassetmanagement.com. Tel: +44 (0)20 7038 7000. Telephone calls may be recorded or monitored in accordance with applicable laws.

The information in this document has not been approved or verified by the SEC or by any state securities authority. Registration with the SEC does not imply a certain level of skill or training. In rendering investment advisory services, SAM may use the resources of its affiliate, Sarasin & Partners LLP (“S&P”), an SEC Exempt Reporting Adviser. S&P is a London-based specialist investment manager and is authorised and regulated by the FCA (FRN: 475111).

SAM has entered into a Memorandum of Understanding (“MOU”) with S&P to provide advisory resources to clients of SAM. To the extent that S&P provides advisory services in relation to any US clients of SAM pursuant to the MOU, S&P will be subject to the supervision of SAM. S&P and any of its respective employees who provide services to clients of SAM are considered under the MOU to be “associated persons” as defined in the Investment Advisers Act of 1940. S&P manages mutual funds in which SAM may invest its clients’ assets as appropriate. To the extent that SAM is able to exercise proxy voting on b half of its clients, SAM follows the policy set by S&P. Proxy voting is an operational process dependent upon support from SAM’s clients’ custodians, some of which do not support proxy voting in all or certain markets.

This document has been prepared for marketing and informational purposes only. It is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice. This document should not be relied on for accounting, legal or tax advice, or investment

recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

Capital at risk. The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance. Management fees and expenses are described in SAM’s Form ADV, which is available upon request or at the SEC’s public disclosure website, www.adviserinfo.sec.gov/Firm/115788.

Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect of any such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct. indirect, special, punitive, consequential or any other damages

(including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

Neither Sarasin & Partners LLP, Sarasin Asset Management Limited nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement.

Where the data in this document comes partially from thirdparty sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2026 Sarasin Asset Management Limited. All rights reserved. This document is subject to copyright and can only be reproduced or distributed with permission from Sarasin Asset Management Limited. Any unauthorised use is strictly prohibited.