The use of alternative assets to improve portfolio diversification and to provide a source of uncorrelated returns has been a longstanding feature of Sarasin & Partners multi-asset portfolios.

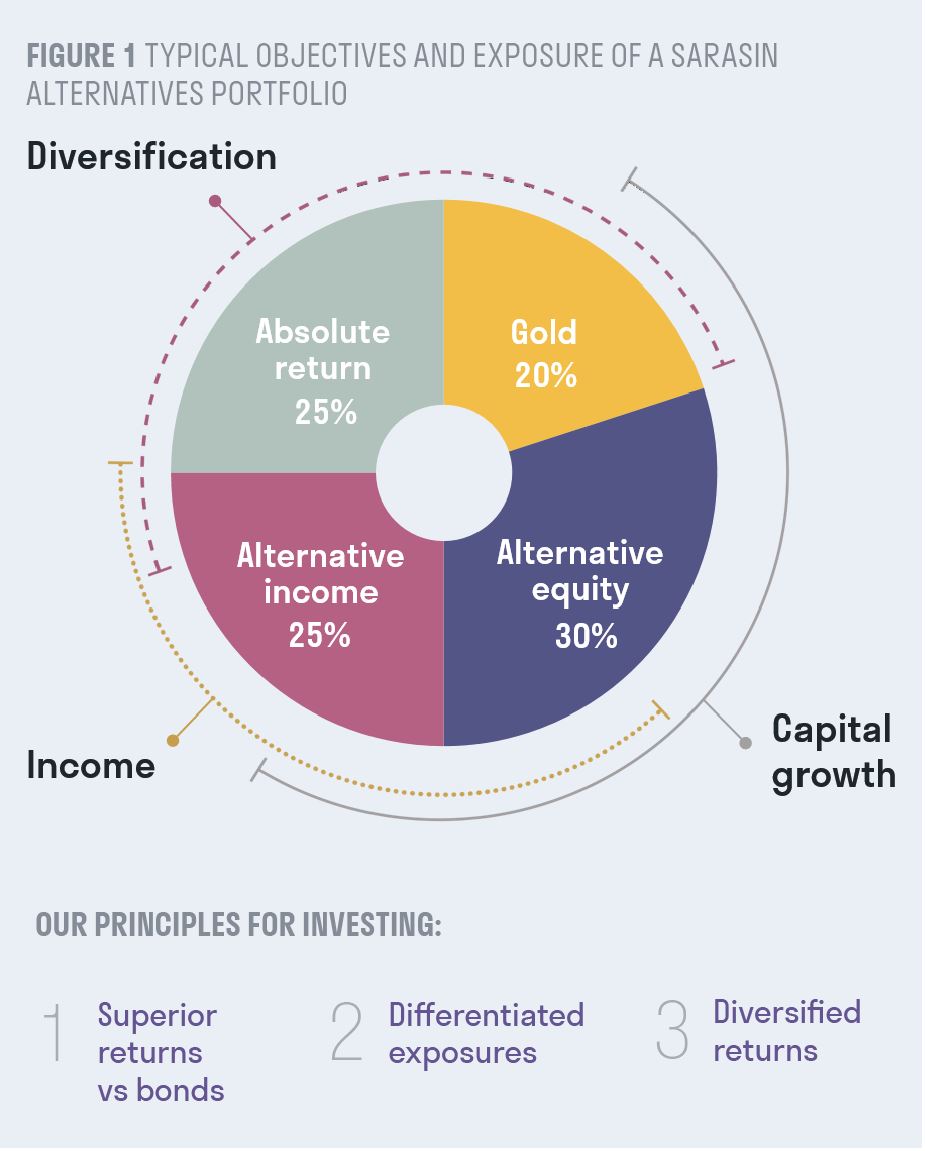

The illustration below sets out our principles for investing in alternatives along with the typical exposures to the different strategies within the investable universe. We continuously review our approach to alternatives exposure to make best use of the available investment opportunities and to find the most efficient means of accessing them. The latter point is especially important in relation to the rapidly growing pool of investment opportunities not quoted on public exchanges, collectively now known as private markets assets, which are set to play an increasingly important role within our alternatives exposure for multi-asset portfolios.

The rise of private markets

McKinsey estimates that private markets were valued at approximately $13.1trn as at 30 June 2023, having grown at an annual rate of 20% since 2018[1]. Private markets cover a wide range of investments such as private equity, private debt and venture capital, and have a long history.

Regulation can have a meaningful impact on how financial markets operate. For example, the regulatory response to the 2008 global financial crisis has led to a safer banking system where stringent rules attempt to ensure banks are not taking excessive risk and have sufficient capital to withstand a large economic shock. This strategy has successfully helped the banking sector to navigate both the impact of the global pandemic and an abrupt change in interest rate policy following the subsequent inflationary shock.

However, with banks now having less flexibility to hold a wide range of investments, many opportunities have either failed to secure funding or had to find other sources of capital to support them, creating an opportunity for long-term investors to fill the void. Companies and their management teams have also increasingly chosen to fund their growth from the private markets rather than by an Initial Public Offering (IPO) with the associated burden of regulatory, reporting and governance costs. These changes in financial regulation, combined with the increased accessibility of private markets and a broadened investment opportunity set, have caused substantial growth over the last 15 years. In addition, private markets investments have delivered strong returns which have attracted large capital inflows.

The impact on public markets

Private markets are still small compared to public: global equities represented by the MSCI All Country World Index have a market capitalisation of $98trn and bond markets represented by the Bloomberg Global Aggregate Index are valued at $66trn as at 31 December 2024. However, since 2018 these indices have grown in size at a rate of only 6% per annum, significantly below that of private markets[2].

This is having a marked impact on public exchanges, with companies staying private for much longer: the median age at which a company becomes listed had risen from six years in the 1980s to 11 years by 2021. Between 1980 and 2000 there were 6,500 Initial Public Offerings (IPOs) in the US, but from 2001 to 2022 there have been less than 3000[3] Databricks, an AI and data analytics business, raised $10bn in December, the largest single private markets fund raising of 2024; according to Databricks, investors tendered double that figure. This is not just a story about capital-light companies such as software providers. Take Elon Musk’s rocket-launching SpaceX business as a prime example. SpaceX is a privately funded company with a valuation of c. $350bn at its last funding round in November when it raised an extra $1.25bn[4]. To set that in context, AstraZeneca, the largest company listed on the London Stock Exchange, has a market capitalisation of around $200bn and had a weight of 8% in the FTSE 100 at the end of December 2024[5].

Most private companies are much smaller than SpaceX, of course, and the majority of activity is in a valuation range of $100m to $10bn. We can see the impact of this within the UK market where last year 88 companies delisted from the London Stock Exchange, with a major driver being acquisitions by private equity firms; by contrast, only 18 new firms were listed in the UK via IPOs[6].

Evolving our approach

Traditionally, the wealth management sector has gained access to private markets opportunities via closed-ended quoted vehicles such as investment trusts. While these vehicles offer a degree of liquidity in normal market conditions, dealing conditions can also deteriorate rapidly. Closed-ended vehicles holding unquoted assets typically trade at very significant discounts to their published net asset values when there are more sellers than buyers for their shares in the market. Hence it is important for us to explore other avenues for accessing private investment markets.

Taking a more illiquid approach can be advantageous for genuinely long-term investors. In periods of economic change and market volatility, the long-term capital funding model of these vehicles remains in place, allowing them to take advantage of attractive valuation opportunities thrown up by short-term fluctuations in market sentiment. We are developing a range of solutions specifically designed to provide tailored access to global private markets opportunities under the leadership of our highly experienced Sarasin Bread Street team (more detail to follow in the next issue).

We expect private markets to continue to grow in size and importance. The inclusion of unlisted private assets within an investment portfolio’s allocation to alternatives can significantly enhance longer term risk-adjusted returns, as many leading academic institutions and charitable endowments have been able to demonstrate in recent years. The challenge for us now is to develop suitable means of accessing the exciting opportunities available in unquoted markets for private investors and charities.

[1] https://www.mckinsey.com/industries/private-capital/our-insights/mckinseys-private-markets-annual-review

[2] Bloomberg and Sarasin & Partners calculations, January 2025

[3] https://www.nasdaq.com/articles/as-companies-stay-private-longer-advisors-need-access-to-private-markets

[4] https://www.bloomberg.com/news/articles/2024-12-10/spacex-share-sale-is-said-to-value-company-at-about-350-billion

[5] Bloomberg and Sarasin & Partners calculations, January 2025

[6] https://www.ft.com/content/aef053ce-c94d-4a72-8dce-bdbf56dd67e1

Important information

This document is intended for retail investors in the US only. You should not act or rely on this document but should contact your professional adviser.

This document has been prepared by Sarasin & Partners LLP (“S&P”), a limited liability partnership registered in England and Wales with registered number OC329859, which is authorised and regulated by the UK Financial Conduct Authority with firm reference number 475111 and approved by Sarasin Asset Management Limited (“SAM”), a limited liability company registered in England and Wales with company registration number 01497670, which is authorised and regulated by the UK Financial Conduct Authority with firm reference number 163584 and registered as an Investment Adviser with the US Securities and Exchange Commission (“SEC”) under the Investment Advisers Act of 1940. The information in this document has not been approved or verified by the SEC or by any state securities authority. Registration with the SEC does not imply a certain level of skill or training.

In rendering investment advisory services, SAM may use the resources of its affiliate, S&P, an SEC Exempt Reporting Adviser. S&P is a London-based specialist investment manager. SAM has entered into a Memorandum of Understanding (“MOU”) with S&P to provide advisory resources to clients of SAM. To the extent that S&P provides advisory services in relation to any US clients of SAM pursuant to the MOU, S&P will be subject to the supervision of SAM. S&P and any of its respective employees who provide services to clients of SAM are considered under the MOU to be “associated persons” as defined in the Investment Advisers Act of 1940. S&P manages mutual funds in which SAM may invest its clients’ assets as appropriate.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance. Management fees and expenses are described in SAM’s Form ADV, which is available upon request or at the SEC’s public disclosure website, https://www.adviserinfo.sec.gov/Firm/115788.

Neither Sarasin & Partners LLP, Sarasin Asset Management Limited nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement.

The index data referenced is the property of third-party providers and has been licensed for use by us. Our Third-Party Suppliers accept no liability in connection with its use. See our website for a full copy of the index disclaimers https:// sarasinandpartners.com/important-information/.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2025 Sarasin Asset Management Limited – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin Asset Management Limited. Please contact marketing@sarasin.co.uk.