Economies are proving resilient to higher interest rates and central banks will be forced to maintain tight monetary policies in the fight against inflation. However, in the wake of the two US regional bank collapses, credit conditions will tighten, accelerating a hard landing that will reduce corporate profitability. As profit expectations fall, amidst heightened geopolitical risk, there will be better opportunities to buy equities ahead.

Softer US inflation data at the end of 2022 and in early 2023 suggested that US price rises had peaked. Global equity markets took heart and the more optimistic mood was boosted by China’s reopening and falling wholesale gas prices in Europe. Markets were led higher by investments that lost most in 2022, with US-listed unprofitable technology companies rising 37% in the first five weeks of 2023, having fallen by 60% to their lowest point in 2022.[1]

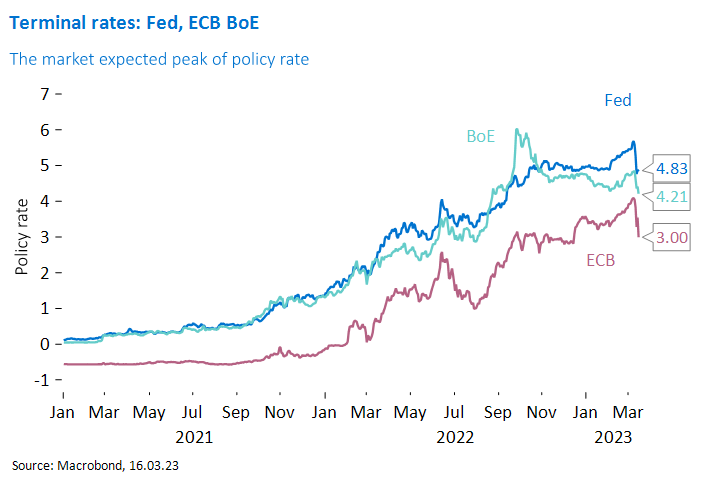

The positive mood was punctured in February by stronger-than-expected US jobs data and above-consensus personal consumption inflation, and bond markets rapidly priced in higher terminal interest rates. But despite 475 basis points of US interest rate increases in the past 12 months[2], the global economy has proved remarkably insensitive to higher rates. Consumers have been insulated by long-duration fixed-rate mortgages, high savings rates and strong balance sheets rebuilt during the pandemic, together with higher wages and inflation-linked government transfer payments.

Improved supply chains, oversupply of some goods and lower energy prices eased inflation, but this has been offset by the service sector running hot. Unemployment rates in developed markets remain low and wage inflation is uncomfortably high in OECD economies.

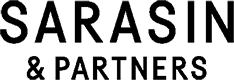

Central bankers are determined to avoid the mistakes of the late 1970s, when policy was eased too early and inflation reaccelerated. With unemployment at record lows, house prices resilient and credit markets orderly, central banks believe they have the flexibility to press harder on the monetary brake. In response, market-implied US terminal interest rates hit 5.7% on 8 March and the US government bond yield curve became as inverted as it had been in 40 years.[3]

The Fed has now found the biting point

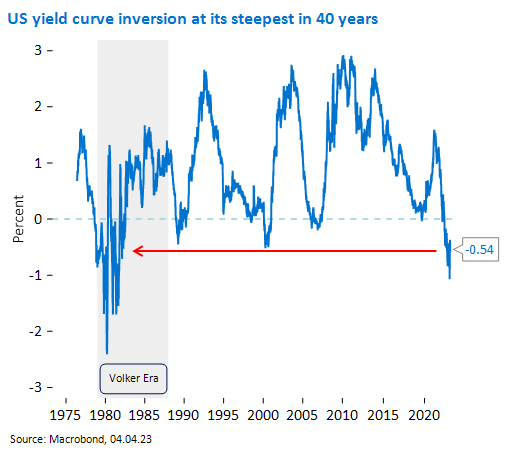

The old adage is that the US Federal Reserve (Fed) raises rates until something breaks. During the past year we have seen losses in speculative equities such as special purpose acquisition companies (SPACs), unprofitable technology companies and meme stocks, while cryptocurrencies and crypto exchanges have collapsed in value. The UK’s liability-driven investment market suffered huge volatility last autumn as a result of higher interest rates and a flawed government growth plan. In each case, the losses were contained and did not result in contagion.

The most recent casualties are Silicon Valley Bank (SVB) and Signature Bank, both of which were vulnerable to potentially crystallising losses on their held-to-maturity assets if customers withdrew deposits. The collapse of these banks and the consequent loss of confidence in the banking sector forced the Swiss authorities to call upon UBS to rescue Credit Suisse, during which $17 billion of contingent convertibles, in the form of Additional Tier 1 (AT1) bonds, became worthless.[4] It remains to be seen if this is the most prominent failure in this cycle.

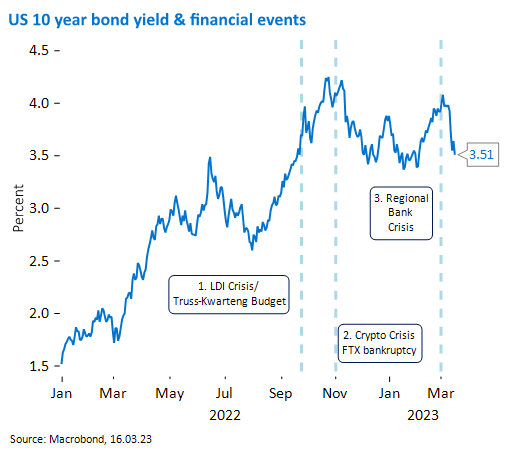

The Fed has now found the biting point at which interest rates will reduce demand in the economy. This point was reached in the financial sector first, but it will transmit to the real economy via tighter credit conditions and reduced velocity of money.

Deposit flight continues to be a problem because mobile banking enables depositors to move their money rapidly. According to JP Morgan, over $500 billion of deposits have fled smaller banks since SVB failed, with $238 billion pouring into US money market funds.[5]

Small and medium-sized banks play an important role in the US, accounting for 50% of commercial and industrial lending, 60% of residential real estate lending, 80% of commercial real estate lending and 45% of consumer lending. The commercial real estate market is of particular concern: it is not clear how regional banks will fare during an impending wave of loan maturities, particularly if tenant vacancies and bad debts accelerate.

Corporate profits remain defiantly above trend

There are now signs that the ‘long and variable lags’ to monetary policy noted by Milton Friedman are beginning to cause housing to soften, company new orders to recede, profit growth to weaken and job gains to slow. The Fed may welcome this in its fight against inflation, but a substantial tightening in credit conditions makes a hard landing much more likely.

Consumers are no longer insulated by government largesse and low interest rates. Their personal savings have declined significantly and consumer credit quality is deteriorating. As unemployment increases, real incomes stagnate, equity prices fall, petrol prices stabilise and access to credit is tightened, there is a risk of a more pervasive decline in consumer confidence and spending.

Corporate profits remain defiantly above trend, supported by high nominal GDP and pricing power, while backlogs of orders, improved supply chains and sticky pricing are supporting sales. But higher prices are leading to demand destruction and, as new order growth slows, we will see a slowdown in sales and a squeeze on margins.

Company earnings forecasts are falling at a pace that is consistent with a recession, but company commentary does not yet reflect any downside to profitability (it rarely does). However, we are seeing a decline in the quality of reported earnings as companies become more creative in their attempts to meet their own guidance and investors’ expectations, and many sectors are now struggling to deliver volume growth. As inflation slows, pricing power will deteriorate, whilst costs will remain sticky due to the lagged effect of wage bargaining and input cost hedging.

If we face a hard landing, then current earnings forecasts for the US and Europe are at least 15-20% too high. We can expect to see Q1 and Q2 company earnings coming in lower than current expectations, with companies citing tighter bank credit and reduced customer confidence.

The deteriorating breadth in the US market is concerning

While bond markets and lower oil prices suggest a hard landing, equity markets have been remarkably resilient. The VIX gauge of US market volatility is at a fairly normal level of 20 and MSCI ACWI is valued at 15x (which is optimistic) 12-month forward earnings.[6] Lower-than-expected equity volatility could be partly related to the explosion in volumes of zero days to expiry (0DTE) options, which tend to supress volatility. It remains to be seen if the prevalence of short-dated options trading leads to a period of disorderly markets.

Equity investors appear to believe that the Fed may cut rates in response to tighter credit conditions and that the Fed’s guarantees of bank deposits equates to a form of quantitative easing. However, when the yield curve troughs, a recession usually begins around eight months later. The S&P 500 index has, on average, reached its market cycle low 17 months after the yield curve begins to steepen.[7]

Within the US equity market, cyclicals have underperformed versus defensives since the end of February as investors began to anticipate a weaker growth outlook. Looking more closely, the deteriorating breadth in the US market is concerning, with the Nasdaq 100, led by large caps such as Nvidia, Meta and Tesla, decisively outperforming the MSCI ACWI. The combined weighting of Apple and Microsoft in the S&P 500 is the highest ever – exceeding IBM and AT&T in 1978. This recalls the 35% echo bubble in the Nasdaq from May to July 2000 and the Covid-19 shock, when investors sought sanctuary in large-cap growth stocks.7

Higher equity prices and falling earnings expectations have made equities more expensive in absolute terms. Real interest rates are now +1.2% whilst they were -1.0% for much of 2020 and 2021, making comparisons of current equity market valuations with those of 24 months ago dangerous.7 Higher short-term interest rates and higher bond yields have made equities relatively more expensive against lower-volatility alternatives. With credit spreads well off their lows and into the 90th percentile of their 10-year average, corporate bonds may offer better relative value than equities, and with a lower risk profile into a recession.[8]

Little in 2023 has so far turned out as predicted

Investors often focus on a single dominant narrative, the current favourite being the relative impacts of a credit crunch and inflation on central bank policy. Unless US bank deposits can be rapidly stabilised, it seems likely other banks will fail. However, little in 2023 has so far has turned out as predicted, and other risks could have a significant bearing on returns.

We are in the early years of a second Cold War in which the axis of China, Russia and Iran has growing influence over the Global South. The China-brokered deal between Iran and Saudi Arabia may yet have profound implications, not least for Israel. In Russia’s hot war in Ukraine the range of potential outcomes remains wide. Meanwhile tensions between the US and China over technology and Taiwan seem likely to escalate.

A weakening US economy, the polarisation of domestic politics and rising interest rates could make the debt ceiling negotiations tense when government funding runs dry this summer. Equity markets took fright when 2011 negotiations were so contentious that the US government came close to defaulting on its debt.

The collapse of SVB and the recent spike in borrowing costs is unhelpful for the private equity industry and venture capital markets in particular. Start-up companies continue to burn cash and will need follow-on funding. The current reset in private asset prices is likely to extend into 2024 and may drag on public markets.

Finally, structurally tighter labour markets, the costs of the energy transition, great power conflict, and volatile commodity prices are all inflationary, and concerns over financial market stability may force central banks to tolerate higher inflation than their published targets. Inflation is also likely to be more volatile than in the past, which will make pricing financial assets more difficult.

The impact of generative AI will be broad, and there are numerous investable beneficiaries

This is a challenging market environment, but there are outstanding opportunities for long-term thematic investors. China’s post-Covid reopening boosts consumption across Asia and supports better economic growth in the region than in the US and Europe. Some short-term disappointment on the apparent lack of stimulus from the Chinese government has led MSCI China to pull back, but this presents an opportunity to invest in select Evolving Consumption and Ageing-related stocks at more reasonable valuations. Risk aversion and a stronger US dollar are unhelpful for sentiment around broader emerging markets, but this too should prove to be a good entry point for a higher portfolio allocation.

Large language models, such as GPT4 and Google Bard, have brought artificial intelligence (AI) to the general public. Unlike the metaverse or blockchain, the impact of generative AI will be broad and there are numerous investable beneficiaries today. A disciplined, thematic investment process is well placed to identify the winners and understand which industries risk being disrupted by change.

The Covid-19 pandemic detonated a demographic bomb in developed economies’ labour markets, with approximately 2 million US workers leaving the jobs market.[9] A low birth rate, the result of the high cost of childcare and falling fertility, means that advanced economies face a falling working-age population and a rising dependency ratio. This increases the need to invest in automation, improve the efficiency of healthcare and encourage consumers to buy savings products.

The US Inflation Reduction Act (IRA) is a step change in the fight against climate change. Goldman Sachs estimates it will unlock $1.2 trillion of investment incentives by 2032. Aspects of the IRA are a competitive challenge to European industrial policy and have prompted a more urgent response from the EU in what amounts to a race to the top. This will spur accelerating investment in renewable energy, power grids, green hydrogen, carbon capture and resource efficiency.

Markets are passing through the most erratic phase of the bear market

The outlook for corporate profitability is weak today, but company earnings will recover, and probably at a faster pace than they fall in a recession. A more defensive approach to theme and industry allocation is warranted, but equities are still the best asset class to access growth and produce attractive long-term real returns.

Markets are passing through the most erratic phase of the bear market, moving from soft landing hope to hard landing fears and the near-inevitability of an earnings recession. The rapid increase in US interest rates has reached its biting point, with the real economy facing tighter conditions and the possibility of more upset in the banking sector.

We have consequently positioned our portfolios more defensively, whilst continuing to invest in higher-quality companies that benefit from our long-term themes. As economic momentum troughs, inflation recedes, monetary policy is eased, the worst of the earnings cuts are priced in and market multiples are lower, there will be excellent opportunities to be brave and add risk. In the meantime, risk-reward is skewed negative: this is a time for patience.

[1] Morgan Stanley, Bloomberg, March 2023

[2] US Federal Reserve, March 2023

[3] Bloomberg, March 2023

[4] Bloomberg, March 2023

[5] JP Morgan, Bloomberg, March 2023

[6] Bloomberg, Factset, Goldman Sachs Global Investment Research, March 2023

[7] Bloomberg

[8] Macrobond, Bloomberg, March 2023

[9] Bloomberg, January 2023

If you are a private investor, you should not act or rely on this document but should contact your professional adviser. This communication is sent on a confidential basis, and you are welcome to discuss the materials with our staff. This information may not be circulated to others without our permission.

The information on which the document is based has been obtained from sources that we believe to be reliable, and in good faith, but we have not independently verified such information and no representation or warranty, express or implied, is made as to their accuracy. All expressions of opinion are subject to change without notice.

US Persons are able to invest in units or shares of Sarasin & Partners LLP funds if they hold qualified investor status and enter into a fully discretionary investment management agreement with Sarasin Asset Management Limited. US persons are U.S. taxpayers, nationals, citizens or persons resident in the US or partnerships or corporations organized under the laws of the US or any state, territory or possession thereof.

This document has been prepared by Sarasin & Partners LLP (“S&P”), a limited liability partnership registered in England and Wales with registered number OC329859, authorised and regulated by the UK Financial Conduct Authority and approved by Sarasin Asset Management Limited (“SAM”), a limited liability company registered in England and Wales with company registration number 01497670, which is authorised and regulated by the UK Financial Conduct Authority and registered as an investment adviser with the US. The information in this document has not been approved or verified by the United States Securities and Exchange Commission (SEC) or by any state securities authority. Registration with the SEC does not imply a certain level of skill or training.

Please note that the prices of shares and the income from them can fall as well as rise and you may not get back the amount originally invested. This can be as a result of market movements and also of variations in the exchange rates between currencies. Past performance is not a guide to future returns and may not be repeated. Management fees and expenses are described in SAM’s Form ADV, which is available upon request or at the SEC’s public disclosure website, https://www.adviserinfo.sec.gov/Firm/115788.

For your protection, telephone calls may be recorded. SAM and/or any other member of Bank J. Safra Sarasin Ltd. accepts no liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of his or her own judgment. SAM and/or any person connected to it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document.

© 2023 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP.