Key points:

- AI is moving from hype to hard deployment, with clear momentum in both infrastructure and enterprise use cases.

- Cybersecurity, and particularly network security, is becoming a key area of investment and consolidation.

- Sarasin aims to find the most compelling tech stock opportunities through the lens of our themes, including Digitalisation and Security.

Recognising significant technological progress in the fields of AI and cybersecurity is a key component of two of our investment themes – Digitalisation and Security. To see how these themes are evolving on the ground, we travelled to Silicon Valley in June 2025 to meet with some of the world’s leading technology companies.

With over 40 meetings across sectors including enterprise software, cloud infrastructure, semiconductors and cybersecurity, the visit offered an invaluable perspective on what is really happening beyond the headlines.

Flying into San Francisco over Santa Clara, it is hard to imagine that the valley now home to the world’s largest technology companies was once occupied by farmers tending sprawling orange groves. Silicon Valley has welcomed waves of innovation going all the way back to the 1950s, with the semiconductor pioneers that settled the valley now living side by side with software tycoons and social media moguls.

Landing at San Francisco International Airport and heading into the city centre, it is difficult to miss the signs pointing to the next wave of innovation. Nearly every billboard we passed was advertising some kind of AI service, providing a striking visual cue to the technological arms race playing out in real time across the Bay. At almost every stop on our trip, from Microsoft to Nvidia to ServiceNow, the message was clear: AI is no longer just a story of potential. AI has arrived.

Enterprise software: sharing AI productivity gains with customers

Our interactions with companies during the trip helped frame our AI investment strategy for enterprise software. We believe that enterprise vendors with defensible market positions, domain specific knowledge, and access to proprietary data sets are well placed for the AI era. The combination of domain expertise and data will enable these companies to develop solutions that make customers more productive. Additionally, vendors with high and defendable market share should be able to share the value of efficiency gains with customers.

For instance, ServiceNow’s raison d’être is enterprise automation, helping customers deliver more effective business processes and reduce costs, and AI is a natural extension of the work it has been doing for the past two decades. ServiceNow is the dominant vendor of business process automation software to large enterprises, with a best-in-class retention rate, and it has a decade’s worth of data and experience in automating the enterprise.[1] During our meeting, the company informed us that it has been testing and refining its AI agent technology internally before releasing it to the public. The results are $350m in cost savings from increased productivity and another $100m in savings from reduced hiring. ServiceNow began shipping its AI agents to customers in May and is aiming to capture 10% of the productivity gains its products deliver to clients.

Similarly, Microsoft is at the leading edge of AI commercialisation, providing its Copilot AI companion software to office workers and supplying the tools and infrastructure for enterprise developers to build and run their own AI applications. Given Microsoft’s unique relationship with businesses, acting as the system of record for many companies, it is the natural partner when businesses are looking to develop their own AI applications. Microsoft’s customers have been using its cloud services to develop proof-of-concept AI projects over the last year. The firm told us that many of those projects are now moving into production, with consumer-facing use cases typically monetising first.

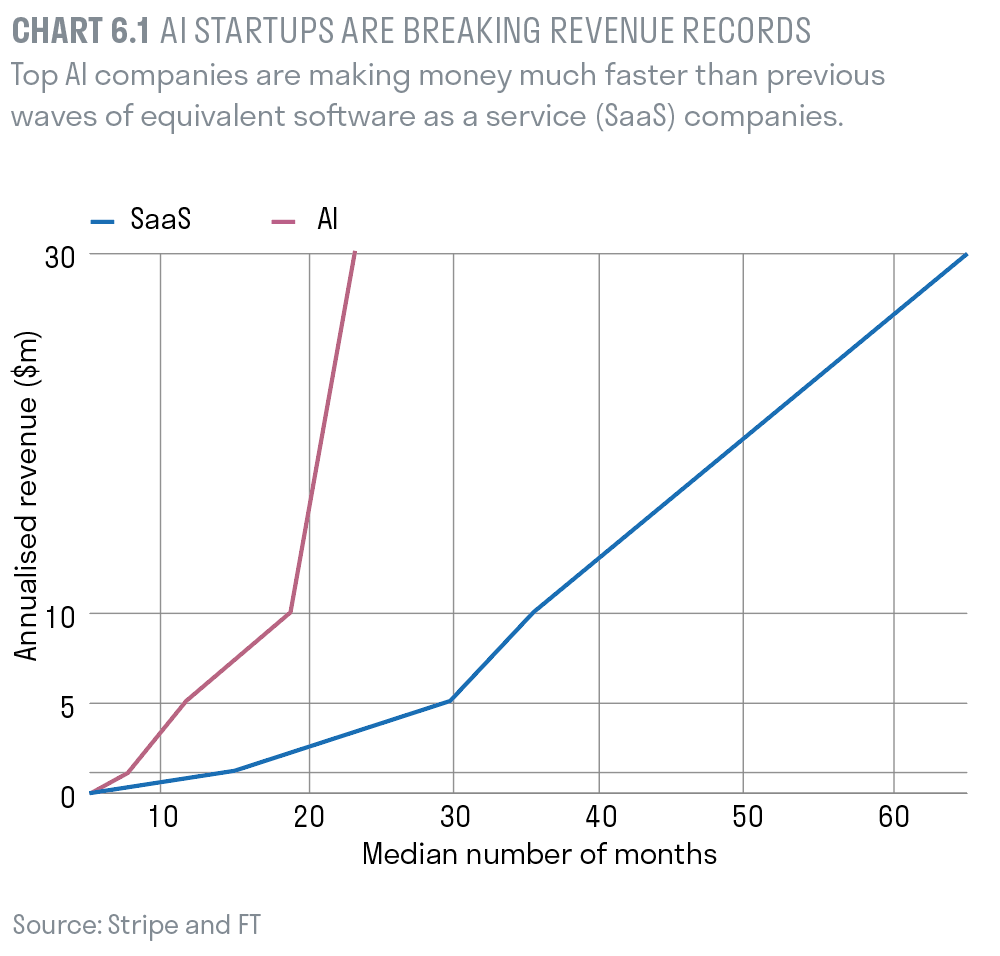

Recent analysis from leading payments group Stripe reveals the acceleration is real. Using data from its annual letter, Stripe noted that in 2024 the top 100 AI startups reached $5m in annualised revenue in just 24 months, compared to around 37 months for the top 100 SaaS companies in 2018.[2] The company’s analysis suggests AI startups now hit $1m annualised revenue in a median 11 months, versus 15 months for software as a service (SaaS) firms, and can reach $30m annualised revenue in just 20 months, which is approximately five times faster.[3] In short: real monetisation is accelerating and then some.

Infrastructure buildout: powering the AI boom

All of this AI activity is driving immense demand for infrastructure. Nvidia, the most prominent beneficiary, sees a surge in inference workloads and a coming wave of demand for reasoning models that could expand the addressable market by 20 times. Developers are not just asking for AI capacity; they want Nvidia’s full software stack.

Nvidia’s strategy has shifted from being a hardware supplier to an AI platform provider. Increasingly, developers are choosing Nvidia’s stack even when hosted on third-party clouds. This trend suggests that market leadership in this space is not just about having the fastest chips but also

about ecosystem control and long-term defensibility.

The company also highlighted a striking observation: customers are now asking how quickly they can scale AI workloads, not whether they should. Return on investment is starting to materialise, especially in areas such as customer engagement, code generation, and process automation.

That infrastructure demand brings with it new constraints. One of the biggest is power. Microsoft is tackling this challenge head-on, signing 20-year clean energy agreements to support its growing estate of AI-enabled data centres. This long-term planning underscores a broader trend we observed throughout the trip: companies are not just scaling quickly, but are also building deliberately.

Cybersecurity: a growing priority for CISOs

Enterprises and governments are locked in a perpetual battle against state-sponsored entities, cybercriminals and hackers attempting to disrupt their operations, with AI opening up new attack vectors for malicious actors to exploit. Consequently, highest priorities for Chief Information Security Officers (CISOs) to work into their budgets.

During our trip, we had the pleasure to meet with Ken Xie, co-founder and CEO of cybersecurity vendor Fortinet, a network security vendor, providing the first line of defence against external attackers. During our meeting, Ken laid out his vision for consolidation in network security and emphasised how he focuses on making the right decisions for the long term.

Protecting the network requires placing hardware in the data centre. As new threats emerge, new layers of defence are required, but stuffing the data centre with boxes (physical devices installed to perform specific network security functions) to protect against each threat would grind the network to a halt. Consequently, there is a strong incentive to consolidate new network security applications into a box from a single vendor, with Fortinet expecting to benefit from this trend for many years to come.

Some 16 years after Fortinet’s initial public offering, Ken still owns 8% of Fortinet’s stock, with his brother and co-founder Michael holding 7%. As owner operators, management is focused on making the right decisions for the long-term success of Fortinet. Ken stated that while competitors may use acquisition to gain new technological capabilities quickly, Fortinet focuses on developing its technology in house. While this may mean being slower to market, the company believes its integrated product development ultimately leads to better security for customers.

Why this matters for investors

The conversations we had reinforced our conviction that the biggest beneficiaries of AI are the enablers: infrastructure providers and enterprise platforms. These companies benefit from:

- Early real-world monetisation

- Defensible competitive advantages (data, network effects, customer lock-in)

- Sticky enterprise relationships

Whether it is Microsoft signing 20-year clean power deals, Nvidia building demand for its full-stack AI platform, or ServiceNow upselling AI agents, the common theme is long-term strategic execution.

From road trip to investment conviction

Our trip to the US reinforced our conviction in two important themes: the real-world deployment of AI, and the growing need for robust, scalable cybersecurity infrastructure. The companies we met are not waiting for regulation or market consensus. They are moving ahead, investing, deploying and delivering products that are already reshaping the enterprise landscape.

As investors, we believe the AI opportunity is not just about the next viral app. It is about the infrastructure, security, and systems that make widespread adoption possible. The real value may lie in companies that remain out of the spotlight, but are powering the platforms of the future.

We left Silicon Valley encouraged by what we saw, not just by the scale of ambition, but by the clarity of vision. In a world increasingly shaped by algorithms, platforms and data, the future belongs to those who build what others depend on.

[1] https://finance.yahoo.com/news/three-reasons-investors-loveservicenow-141839070.html

[2] https://techcrunch.com/2025/02/27/stripe-ceo-says-ai-startupsare-growing-faster-than-saas-ever-did-and-calling-themwrappers-misses-the-point/

[3] ft.com/content/a9a192e3-bfbc-461e-a4f3-112e63d0bb33

Important information

This document is intended for retail investors and/or private clients. You should not act or rely on this document but should contact your professional adviser.

This document has been issued by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England and Wales with registered number OC329859, and which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance.

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2025 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP. Please contact marketing@sarasin.co.uk.