A year ago, we wrote that the generative AI hype was rooted in genuine breakthroughs, forecasting significant long-term impacts and identifying hardware players as clear beneficiaries. Since then, AI has continued to dominate both news headlines and stock market performance, with the gap between perceived AI winners and losers growing ever larger.

Rewriting the rules: the AI growth trajectory

The pace of AI development has surpassed even the most optimistic predictions. ChatGPT's meteoric rise – amassing 100 million users within three months of launch – is more than a technological feat; it's a financial phenomenon. Recent reports suggest OpenAI's annual revenue run-rate has jumped to more than $2 billion (by February this year) from $1.3 billion a mere eight months ago.[1]

The AI arena has become fiercely competitive. ChatGPT now contends with Google's Gemini and Anthropic's Claude, forming a triumvirate of leading-edge AI models. Meanwhile, Meta and others are in close pursuit with a diverse array of models optimised for openness, cost, speed, transparency or other specific attributes.

The AI arms race: investment at unprecedented scale

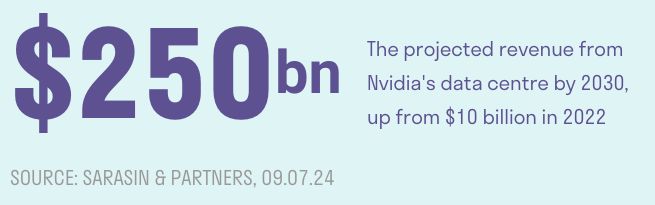

The scale of investment pouring into AI is staggering, with tech giants, startups and governments vying for supremacy. Nvidia's data centre division, which supplies graphics processing unit (GPU) chips crucial for AI model training and inference, exemplifies this trend. Our research team projects its annual revenues will surge from $10 billion in 2022 to approximately $100 billion in 2025, and potentially exceed $250 billion by 2030.[2]

Financial markets have taken note, pricing in significant AI-driven growth across the tech sector and beyond. Investors have largely welcomed big tech's massive AI-related capital expenditures, anticipating future profitable revenue streams. Apple's recent announcement of AI features exclusive to newer devices underscores this strategy, with investors optimistic that these innovations will drive device upgrades and reinvigorate sales growth.

The road ahead: humans 2.0?

In the near term, AI is likely to prove a complement, rather than a replacement for humans. In the modern world, most human work consists of a wide range of tasks that are multiplicative, not additive; this means if just one task is done badly, the entire job suffers. Combined with a principle known as Moravec's Paradox, the counterintuitive notion that tasks humans find easy often prove challenging for AI (and vice versa), this suggests that AI could follow the well-worn path of new technologies that fail to translate into the expected productivity benefits.

However, AI's trajectory differs from traditional tech cycles in a crucial aspect. Recent AI progress hasn't stemmed from a single, dramatic breakthrough. Instead, the key insight has been the deceptively simple 'scaling law': as models grow larger, they become more capable. This relationship between scale and intelligence has held consistent over the last decade, suggesting that if compute power used in training frontier models increases by an order of magnitude, we can reasonably expect a corresponding leap in model intelligence.

The next generation of models, trained with significantly more compute power, are already in development and expected to arrive at some point in 2025. Whether the scaling law holds for GPT-5 and its peers is one of the most important unknowns today.

The AI supercycle: potential for sustained growth

The potential for AI to maintain its dramatic improvement rate underpins the long-term optimism reflected in the valuations of Nvidia and other AI-related companies. Even if the current generation of AI is on course to experience a relatively typical hype cycle, the release of vastly more capable models can reduce this timeline, reigniting interest and investment. Each new model could launch a new superlinear curve before the previous curve has passed its peak, potentially combining to deliver consistent, and exponential, overall growth.

If this scenario unfolds over the coming years, the impact on the global economy could be truly transformative. In this context, many long-term AI beneficiaries may still be undervalued today.

The bear case: potential roadblocks

While the optimistic scenario is plausible, it's not guaranteed. Two significant challenges could derail the AI boom:

The scaling law breaks: if ‘Moore's Law for AI’ falters after the next generation of models, expectations for future AI progress may reset significantly lower.

Physical world constraints: while funding for next-generation models isn't yet prohibitive, physical limitations are emerging in areas like datacentre capacity and electricity supply.

These constraints, if they prove binding, wouldn't spell the end of AI progress. The field remains nascent, with ample opportunities for advancement in algorithm design, hardware efficiency, and product development. Shortages of physical inputs, such as chips or electricity, will be overcome in time, particularly if the economic incentives to do so remain great. However, they may moderate expectations for the pace of future progress, potentially shifting corporate attitudes from fear of missing out to a more calculated focus on optimising AI investments, and valuations of ‘AI winners’ would likely reset lower.

Implications for investors: navigating the AI revolution

The progress and potential of AI are undeniably phenomenal, matched by an equally breathtaking level of investment from semiconductor and cloud computing giants. This AI boom has driven expectations for these companies, and by extension the broader market, to new heights.

Unsurprisingly, beneficiaries of the AI theme form a material proportion of our client portfolios today. Our holdings can broadly be split into three categories:

AI enablers – the ‘picks and shovels’ companies such as Nvidia and TSMC, that are already reaping the benefits from the huge increase in excitement and spending on AI tools and hardware. As spending grows and physical world constraints become more salient, this category is broadening to include companies far from the tech sector, such as electric utilities.

AI platforms – the giant tech leaders such as Microsoft, Alphabet, Amazon and Meta, that are using their existing scale, particularly in data centres and compute, to ensure that they are well positioned for whatever threats and opportunities this technology brings.

AI adopters – companies that are generating material, tangible benefits from AI today remain in short supply, but as workers and companies learn to navigate the ‘jagged frontier’ of this technology, this will steadily improve. Companies with large, proprietary datasets such as CME or Mastercard are likely to form the vanguard of this group.

In this environment we are careful to balance enthusiasm with prudence in our portfolio construction. We are acutely aware of the strong stock market performance of many of these companies in recent months, and we actively manage position sizes within and across these categories. More broadly, we are keeping a vigilant eye for signs that the scaling law breaks down or that physical world constraints are proving an insurmountable hurdle, but in the meantime we expect AI winners will likely continue to form a material proportion of our equity portfolios.

[1] OpenAI on track to hit $2bn revenue milestone as growth rockets, Financial Times, February 2024

[2] Sarasin & Partners, 08.07.24

This document is intended for retail investors in the US only. You should not act or rely on this document but should contact your professional adviser.

This document has been prepared by Sarasin & Partners LLP (“S&P”), a limited liability partnership registered in England and Wales with registered number OC329859, which is authorised and regulated by the UK Financial Conduct Authority with firm reference number 475111 and approved by Sarasin Asset Management Limited (“SAM”), a limited liability company registered in England and Wales with company registration number 01497670, which is authorised and regulated by the UK Financial Conduct Authority with firm reference number 163584 and registered as an Investment Adviser with the US Securities and Exchange Commission (“SEC”) under the Investment Advisers Act of 1940. The information in this document has not been approved or verified by the SEC or by any state securities authority. Registration with the SEC does not imply a certain level of skill or training.

In rendering investment advisory services, SAM may use the resources of its affiliate, S&P, an SEC Exempt Reporting Adviser. S&P is a London-based specialist investment manager. SAM has entered into a Memorandum of Understanding (“MOU”) with S&P to provide advisory resources to clients of SAM. To the extent that S&P provides advisory services in relation to any US clients of SAM pursuant to the MOU, S&P will be subject to the supervision of SAM. S&P and any of its respective employees who provide services to clients of SAM are considered under the MOU to be “associated persons” as defined in the Investment Advisers Act of 1940. S&P manages mutual funds in which SAM may invest its clients’ assets as appropriate.

This document has been prepared for marketing and information purposes only and is not a solicitation, or an offer to buy or sell any security. The information on which the material is based has been obtained in good faith, from sources that we believe to be reliable, but we have not independently verified such information and we make no representation or warranty, express or implied, as to its accuracy. All expressions of opinion are subject to change without notice.

This document should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this material when taking individual investment and/or strategic decisions.

The value of investments and any income derived from them can fall as well as rise and investors may not get back the amount originally invested. If investing in foreign currencies, the return in the investor’s reference currency may increase or decrease as a result of currency fluctuations. Past performance is not a reliable indicator of future results and may not be repeated. Forecasts are not a reliable indicator of future performance. Management fees and expenses are described in SAM’s Form ADV, which is available upon request or at the SEC’s public disclosure website, https://www.adviserinfo.sec.gov/Firm/115788.

Neither Sarasin & Partners LLP, Sarasin Asset Management Limited nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of their own judgement.

The index data referenced is the property of third-party providers and has been licensed for use by us. Our Third-Party Suppliers accept no liability in connection with its use. See our website for a full copy of the index disclaimers https:// sarasinandpartners.com/important-information/.

Where the data in this document comes partially from third-party sources the accuracy, completeness or correctness of the information contained in this publication is not guaranteed, and third-party data is provided without any warranties of any kind. Sarasin & Partners LLP shall have no liability in connection with third-party data.

© 2024 Sarasin Asset Management Limited – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin Asset Management Limited. Please contact marketing@sarasin.co.uk.