Despite abundant evidence of the damage implied by climate change, markets are still underestimating its effects. A global thematic lens and climate risk analysis of companies keep our focus on the long-term opportunities for investors.

The latest research shows the world is about 1.6°C warmer over land masses than it was during the pre-industrial age. Our current trajectory takes us towards 3°C of warming by the end of the century.[1]

To grasp the potential economic impact of our current climate trajectory, it helps to consider what might happen to economic growth under different scenarios. Research[2] shows that even if we achieve net zero by 2050, current growth forecasts could be 4% too high. This could be much worse.

If we choose not to address climate change, current growth forecasts could be almost 20% too high.

Governments are increasingly waking up to what is at stake, making policy responses that force change a near inevitability. It is also clear that companies and investors should consider the risks, as well as the opportunities, that climate change presents.

A $6 trillion wave of investment opportunity

To achieve the targets of the Paris Climate Agreement, we need to reduce CO2 emissions very quickly. This could result in the largest wave of capital investment yet seen in human history.

Spending to address climate change was approximately $680 billion in 2021. According to the Intergovernmental Panel on Climate Change and other estimates, we must increase annual climate-related spending by several orders of magnitude if we are to keep global warming to below 2°C. While projections vary, it is estimated that we will need to reach annual climate spending of $6 trillion by 2040, and to continue to invest at this level [3].

This gives a sense of the sheer scale of the investment opportunity available, as capital is deployed across the world to make the transition to low carbon. How we source and use energy must clearly change, but we must also invest significant capital in all areas of the global economy, from clean transport to sustainable buildings, agriculture, materials and digital technology.

Why do markets misprice climate change?

We know the risks associated with climate change and we know the scale of the investment opportunity. It therefore seems strange that markets are still mispricing climate change and the transition to low carbon. Despite decades of discussion about climate change, the ratio of fossil fuel investment to renewable energy investment, at 0.9, is still very low.[4]

This could be down to how capital markets operate, low data availability and psychological biases. Capital markets are not used to dealing with the sudden, significant changes that may occur with global warming, such as climate tipping points. Nor are they equipped to deal with the uncertainty and long time periods involved in climate change analysis.

Indeed, a lack of data about current emissions and how climate change could affect businesses, together with a focus on short-term investment performance, draw attention away from the implications of failing to transition to low carbon. This feeds a deeply human flaw: hyperbolic discounting. We prefer to receive rewards sooner rather than later, while downplaying risks that appear to be far in the future. Unfortunately, the reality is that climate change is already having an effect – and in many instances, significantly more quickly than anticipated.

Investors may also have a beat-the-gun mentality: they appear to see the risks of investing in specific stocks and sectors, but believe that they will be able to profit from and exit their positions before the rest of the market does. They cannot all be right.

Forward-looking analysis to identify risks and opportunities

Simply excluding companies with high CO2 emissions from portfolios is an effective way to reduce the carbon footprint of a portfolio, but it has little impact on the real world. Less choosy investors, who are unlikely to press the company to reduce its emissions, may buy an excluded company cheaply. For this reason, we engage with companies to push for beneficial change, often in concert with other aligned investors.

It is also vital to develop analytical approaches that match the complexity of climate-related issues. For example, carbon footprinting – which is widely used to track companies’ carbon intensity – shows only part of the overall picture. Among other things, it tends to ignore scope three emissions. These are produced as result of a company’s activities by its suppliers or customers. In the case of oil and gas firms, some 90% of their emissions are scope three.

Carbon footprints also give a static snapshot in time. As asset managers committing our clients’ capital to long-term investments, the direction of travel is crucial. Our focus is not on where emissions are today, but where they are likely to be in future based on how companies are allocating capital to mitigate climate risk.

A forward-looking approach is therefore key to our climate value at risk (CVaR) analysis of companies. By combining CVaR with more conventional financial and qualitative analysis, we integrate climate-related variables into our analysis, including emissions, carbon pricing and exposure to risks such as rising sea levels.

How do climate risks impact a company’s value?

CVaR is a way to measure and predict the financial risks that climate change can pose to a business. Using net zero assumptions in CVaR analysis can generate a significantly different net present value for a company relative to traditional analysis. For example:

- analysing an oil and gas company in this way generally reduces expected volumes, margins and revenue, and increases the cost of capital;

- a number of tech and service companies can be subjected to aggressive carbon pricing assumptions without material impact to expected cash flow generation or net present value; and

- Where mining companies could see vastly increased demand for copper, lithium or rare earths, we may find that the market is under-pricing the potential climate opportunity.

A thematic lens helps bring the potential climate winners into focus

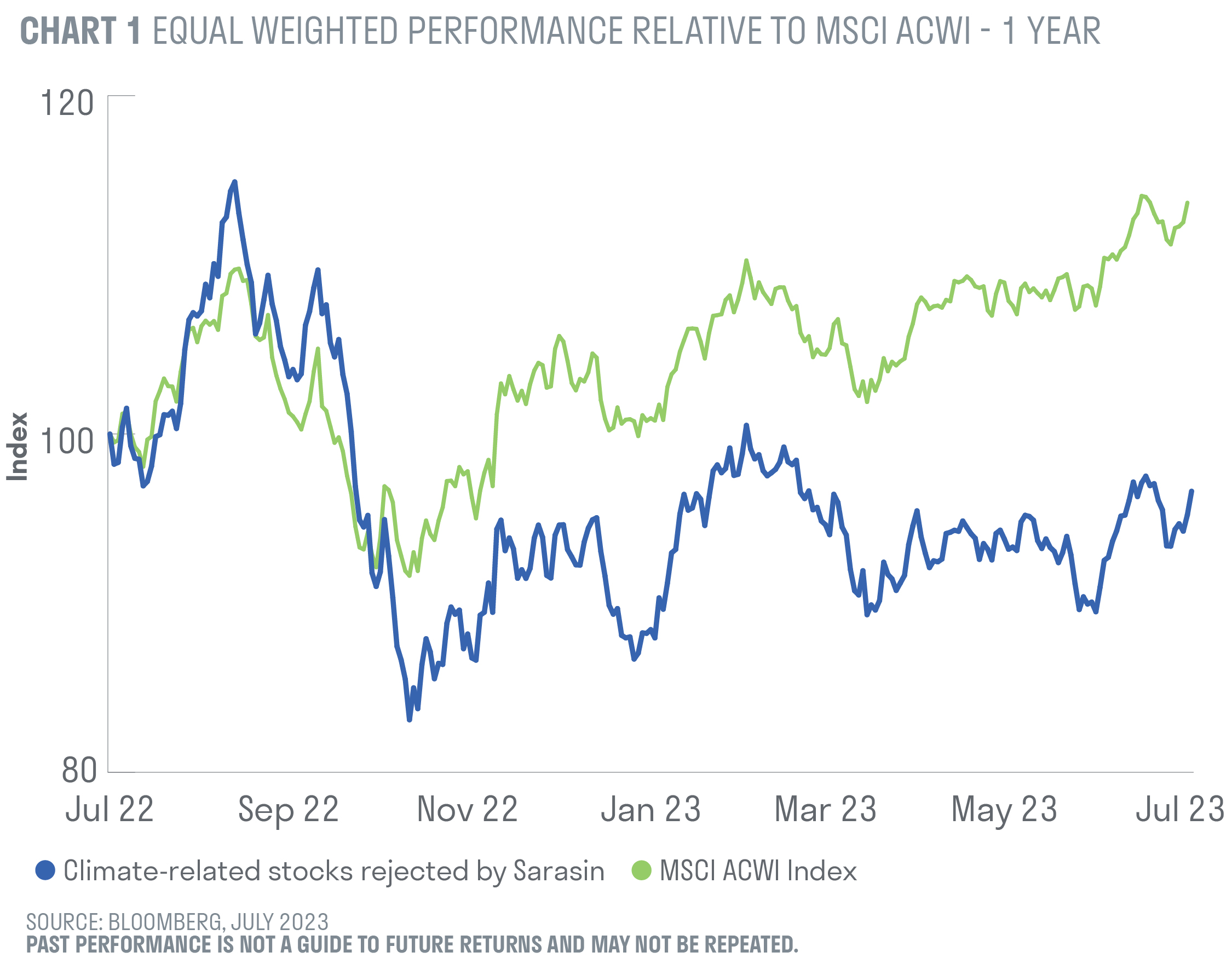

Viewing the world through a thematic lens helps us see connections, risks and opportunities that may not be apparent when focusing on specific sectors or geographical regions. In the process, we reject many investment ideas, but the payoff in terms of risk reduction is worth it, as illustrated in chart 1. This shows how climate-related stocks that we have rejected have underperformed against the broader market.

A nuanced thematic approach also helps avoid overly simplistic choices. For example, two of the most popular areas of climate-related investment are renewable energy and electric vehicles (EV). Over the past 30 years the installed capacity of wind power has increased sharply, but during the same period the return on equity of the world’s four main wind turbine manufacturers has fallen significantly.

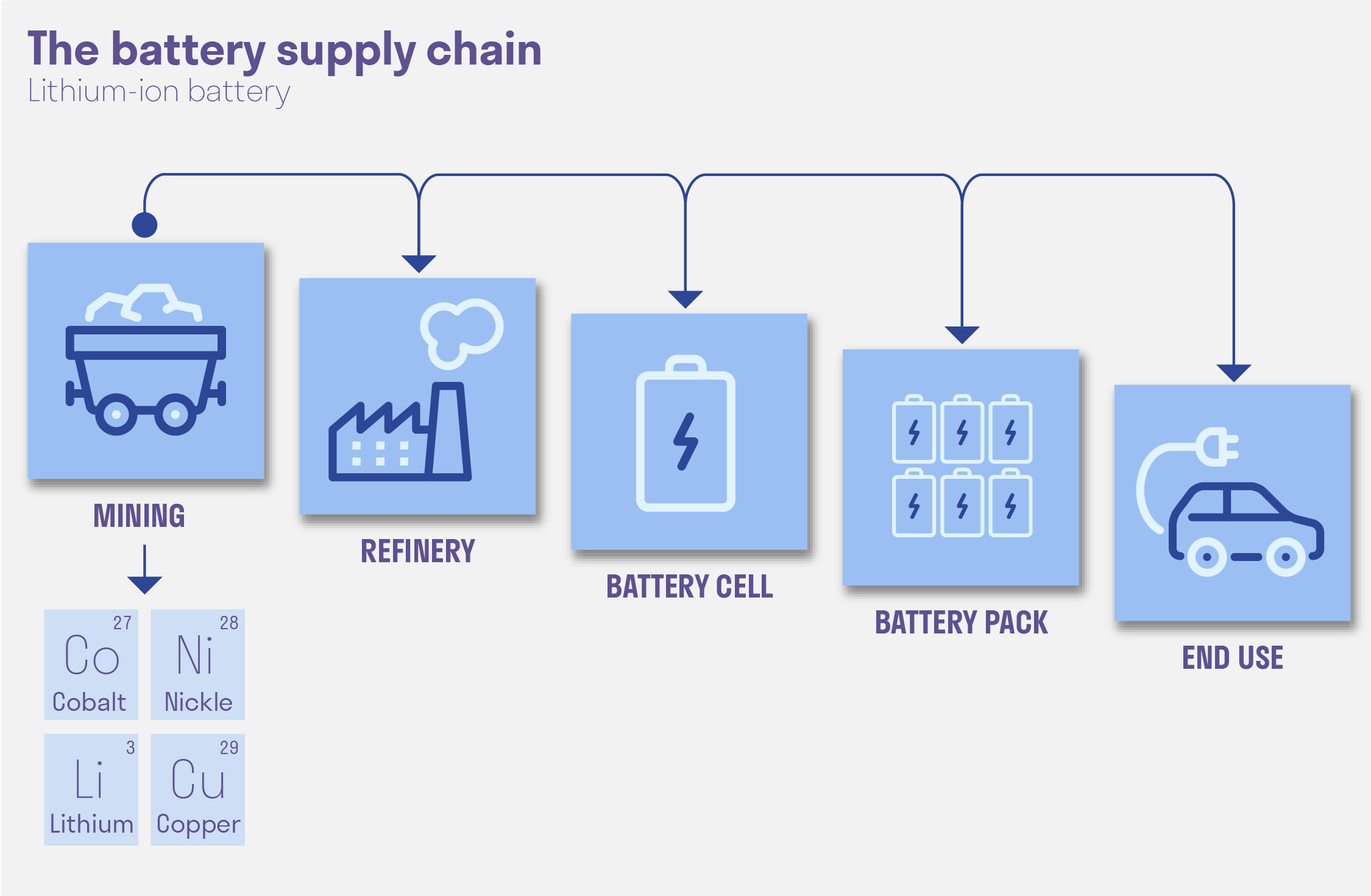

Likewise, the EV market is growing rapidly, but as the graphic shows, the sheer complexity of its supply chains calls for deep research to identify where long-term value really lies. Picking volume winners is not necessarily a winning strategy.

Our approach has led us towards less immediately obvious climate-related investments. These include firms such as TetraTech (helping companies with water management through advisory and planning services), Hexagon (provider of hardware and software solutions, such as sensor technology for buildings) and Quanta Services (offers services that facilitate the decarbonisation of energy systems). We believe these businesses are well positioned to help upgrading infrastructure, utilities and companies’ assets to meet the challenges of climate change. We also consider companies supplying raw materials and equipment needed for the transition to lower carbon, such as Rio Tinto, Siemens, Alstom and Air Liquide.

What these companies all have in common is the potential to protect our clients’ capital and continue to deliver durable cash flows for years to come – in addition to being currently mispriced by the market. While the risks of climate change are readily apparent, thoughtful analysis brings the investment opportunities into view.

[1] Synthesis Report of the IPCC Sixth Assessment Report (AR6), 2021, p.6

[2] The Network for Greening the Financial System is a network of 114 central banks and financial supervisors that aims to accelerate the scaling up of green finance and develop recommendations for central banks' role for climate change.

[3]Global Landscape of Climate Finance 2021 & IPCC

[4] Bloomberg, growth in energy supply investment ratio needed to meet ETS and NZS decadal average targets, estimate for 2021.

Important information

If you are a private investor, you should not act or rely on this document but should contact your professional adviser.

This document has been approved by Sarasin & Partners LLP of Juxon House, 100 St Paul’s Churchyard, London, EC4M 8BU, a limited liability partnership registered in England & Wales with registered number OC329859 which is authorised and regulated by the Financial Conduct Authority with firm reference number 475111.

It has been prepared solely for information purposes and is not a solicitation, or an offer to buy or sell any security. The information on which the document is based has been obtained from sources that we believe to be reliable, and in good faith, but we have not independently verified such information and no representation or warranty, express or implied, is made as to their accuracy. All expressions of opinion are subject to change without notice.

Please note that the prices of shares and the income from them can fall as well as rise and you may not get back the amount originally invested. This can be as a result of market movements and also of variations in the exchange rates between currencies. Past performance is not a guide to future returns and may not be repeated.

The index data referenced is the property of third party providers and has been licensed for use by us. Our Third Party Suppliers accept no liability in connection with its use. See our website for a full copy of the index disclaimers. https://www.sarasinandpartners.com/docs/default-source/regulatory-and-policies/index-disclaimers.pdf

Neither Sarasin & Partners LLP nor any other member of the J. Safra Sarasin Holding Ltd group accepts any liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. The use of this document should not be regarded as a substitute for the exercise by the recipient of his or her own judgment. Sarasin & Partners LLP and/or any person connected with it may act upon or make use of the material referred to herein and/or any of the information upon which it is based, prior to publication of this document. If you are a private investor you should not rely on this document but should contact your professional adviser.

© 2023 Sarasin & Partners LLP – all rights reserved. This document can only be distributed or reproduced with permission from Sarasin & Partners LLP.