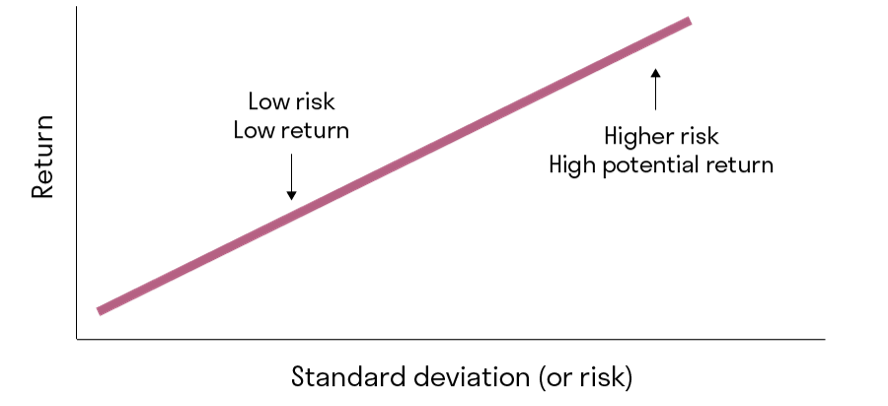

The risk/return tradeoff

One of the most fundamental concepts in investment is the relationship between risk and return. The more risk you take, the greater your potential financial return. But with this risk comes the possibility of losing money.

The potential reward may be higher, but the likelihood of achieving it is reduced.

This is why the relationship between risk and return is often known as the risk-return trade-off. An investor who chooses high-risk investments may have a higher potential financial reward. However, what they have gained in potential return, they have lost in certainty - the potential reward may be higher, but the likelihood of achieving it is reduced. Conversely, an investor who chooses low-risk investments has sacrificed the potential for high returns, but their chances of achieving that lower return are higher.

The risk-return spectrum illustrates the relationship between risk and return. The higher the required return, the greater the risk that needs to be taken.

Risk/Return Tradeoff

Equities

Equities, which represent an ownership stake in a business, are generally riskier than bonds, which are a form of loan an investor makes to a company or a government in return for regular income payments. Government bonds from certain countries, such as the US, are in fact often thought of as being ‘risk-free’ as it is considered extremely unlikely that the US government will default on debt.

Multi-asset funds

Multi-asset funds, which may comprise both bonds and equities, as well as other asset classes, vary in terms of risk profile. A multi-asset fund with a lower percentage of equities may be suitable for an investor who wishes to take less risk, while an investor who wishes to maximise their chances for return may prefer to invest in a fund that has a greater percentage of equities.

An investor’s approach to risk and return may be informed by their personal circumstances as well as their time horizon. An investor who has enough money to cope with financial loss may feel more comfortable taking greater risk. Likewise, an investor who has a long time horizon ahead of them may have a greater capacity for risk, as this gives their portfolio the ability to recover from short-term losses. However, personal circumstances aside, everyone’s risk tolerance is different. If the prospect of losing money, even in the short-term, keeps you up at night, it may be that your risk tolerance is low, even if you have a long investment horizon and a sizeable financial buffer.