The last few months have been nothing short of turbulent for the oil and gas industry.

In something resembling a perfect storm, the physical producers of these commodities and its derivatives are frantically reducing supply, while the financial backers exposed to the sector are desperately offloading risk and consumers are reining in demand.

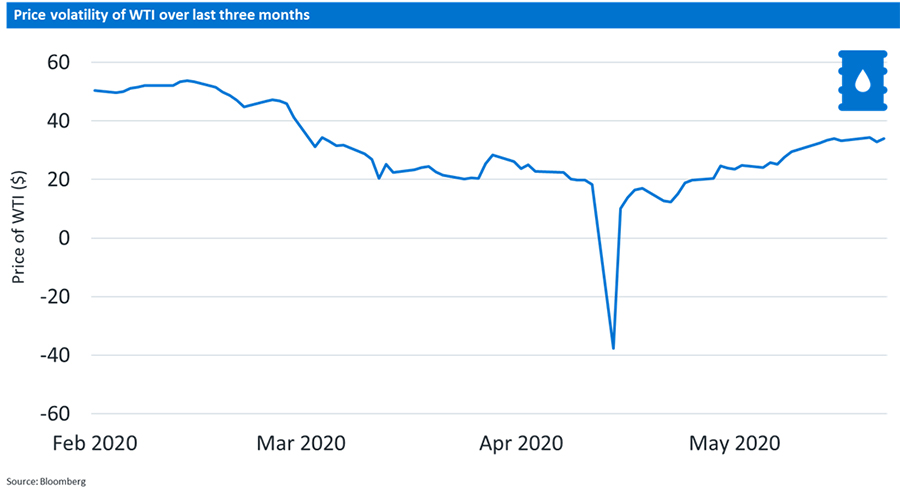

This temporary dislocation in the supply chain has caused a dip into negative oil prices followed by a strong recovery, surpassed in strength only by the 35% increase in gas prices. Closer to home the consumer may be blissfully unaware of the commotion as prices at the petrol pump have flatlined.

As the supply chain recovers and lockdowns ease we anticipate energy prices to stabilise at around $40 for WTI Crude and $3 for US natural gas. Clearly, any evidence of a second wave of COVID-19 infections would cause a reversion to the current scenario.

While conditions remain uncertain, here are the most prominent themes that we expect to play out over the next 12 months.

Expect higher energy costs

The market for future oil prices – a key mechanism for managing oil price risk for any organisation that needs to buy oil – has been highly volatile, to the extent that the current oil price often trades higher than future oil contracts. Bear in mind that current prices are nearly half the levels of a year ago. This clearly increases risk – and therefore cost – for those producing oil, and those that have to fund this production.

It is particularly significant for US onshore oil where private equity companies control approximately 40% of the production. We also believe this will influence what is considered by investors as an acceptable debt-to-equity ratio in energy companies, to compensate for higher risk.

Impact: This is negative for small and medium-sized (SME) US onshore oil energy and petroleum – as well as oil service companies and domestic US pipeline infrastructure. It is potentially positive for larger companies in a position to buy up distressed assets or those with a substantial customer base with which to protect them against risk, such as Glencore, Vitol, etc.

Impact for our investors: We have not invested your portfolios in any of the abovementioned sectors that are at risk.

Refineries will have a six-month bonanza

The levels of gasoline inventory stock have started to shrink. After an initial fall of 80% in aviation fuel and 70% in gasoline demand, we have started to see a rebound. As the clearest indication of what is likely to follow for the rest of the world, Beijing’s traffic volumes are between 2-8% higher than that of this time last year as people return to work, but shy away from using public transport.

Sadly, the pause in carbon emissions that occurred during the global economic lockdown period may revert to greater than normal pollution in quick order.

Refineries will benefit from refilling with energy at lower prices, and a higher value offering to their clients. While this margin is normally quite slim and dependent on volumes, the next six months could see wider margins and bigger volumes.

Impact: This is negative for the driving consumer and the environment. We expect refineries (Total has significant exposure to refining), integrated energy companies with forecourt sales (Shell is the largest of these) and the government through tax intakes, to benefit.

Impact for our investors: There are very few structural growth opportunities to this theme – it tends to be the domain of short-term traders and physical operators. As such we do not have any investments which capitalise on this near-term disequilibrium.

US gas prices will rise

Gas is often an unwanted by-product of US shale oil production, and mainly used in power production where it competes with coal. It is rarely used for domestic heating or industrial processes. The 30% decrease in shale production means that gas output is lower too.

Yet, power demand is only 10% lower. Unlike oil, gas is not readily stored. As the US kick starts its economy we are likely to see power demand bounce back but with gas supply remaining subdued. Prices have already strengthened but probably have further tailwinds. The US has latent gas export capacity and will restart exporting but it will have to await the reawakening of economic activity in European and Asia.

Impact: This is negative for the US consumer who is likely to be impacted by rising utility bills. We anticipate that US renewable utilities will benefit from higher wholesale prices.

Impact for our investors: We have invested in NextEra and Orsted, in the US renewable energy sector.

Oil equities de-rate (even more)

It is clear that the energy sector is now set for another three – or more – years of value destruction. These companies have failed to cover their capital costs since 2015, with a structural decline of total shareholder returns. Lower yields on already cut or threatened dividends is unlikely to lure investors back.

Impact: This is negative for energy equities. This can be positive for utilities where a comparable yield can be obtained for less risk.

Impact for our investors: We have negligible exposure to energy equities. We have exposure to 3 utilities with renewables biases.

OPEC collapses

There has been a lot of noise in the market pointing to the irrelevance of oil production quotas. However, when the normal level of global dis-equilibrium is re-established, the Organisation for Petroleum Exporting Countries (OPEC) is likely to reassert itself. US production growth and the arguments for its self-sufficiency has taken a blow. Russia and other oil economies need cash. State-owned enterprises control nearly 40% of global oil production and here cash constraints are immense.

Impact: This is negative for Russia, but Aramco – the Saudi Arabian Oil Company – is expected to benefit.

While the next 12 months still hold a number of uncertainties for the world economy, we believe these trends point to even greater support for renewable energy. Renewable assets have shown uncorrelated performance to that of the oil and petroleum market during the impacts of the COVID-19 environment. Renewable power generation remains a highly attractive investment area, despite some valuations that are somewhat extended.